A lack of proper asset management system can hurt your investment. According to Assetspire, 43% of small businesses still rely on traditional or manual methods to manage their assets, with some not having any asset inventory at all.

This lack of digitalisation or data automation can result in either an excess or shortage in asset inventory and ultimately financial loss for a business.

When your organisation suffers from a lack of inventory, you are more likely to face these asset management challenges: difficulty in making informed decisions about asset management and operations, loss of potential savings, lack of visibility into your assets’ status, and wasted time spent on organising your assets.

To avoid decisions that could negatively impact your investment, it is vital to select the tool that perfectly fits your needs and objectives. The best digital app or software for you will depend on which types of assets you own, whether they be high-value investments, collectables, memorabilia, or real estate.

If you have a diverse portfolio, a comprehensive asset management software can be the best solution for you.

Listed below are the essential features to look for before picking the best asset management software (AMS) for you. After reading this article, you will be equipped with the knowledge needed to make informed decisions on how to leverage technology into your asset management process.

- What is Asset Management Software?

- Top 10 Tools For Managing Assets

- Why Do You Need an Asset Management Software?

- Key Features to Look For in an Asset Management Solution

- Before You Purchase An Asset Management Application

- Ready to Choose Your Asset Management Solution?

- Automated Asset Management: Frequently Asked Questions

What is Asset Management Software (AMS)?

According to Techopedia, asset management software is a specialised application used to document and monitor an asset throughout its entire life cycle, from acquisition to disposal.

How can asset inventory and management software save you time? Instead of searching for documents in a stack of binders or manually updating a spreadsheet, the software enables you to refer to data from various sources connected to your unified platform.

It provides a comprehensive and detailed overview of all your assets, ensuring you stay well-informed about essential details related to each asset.

This covers details such as location, acquisition costs, and other pertinent information, contributing to a thorough understanding of your asset portfolio.

Top 10 Tools For Managing Assets

Now that you know which features are essential and the elements you need to consider before making your choice, below is a curated list of software options to help you manage your asset lifecycle. It may be good to have a list of your “must haves” handy.

| Software | Overview | Best For | Starting Price | Free Trial | Pros | Cons |

|---|---|---|---|---|---|---|

| Exirio | A wealth management app that tracks all your investments, in any currency. It helps understand what you own, and how it is performing. | Expat investors and entry-level investors. | $10/month | Available in both free and premium versions (additional features). | a. Has free version (limited features). b. Data can be uploaded in bulk via CSV files. c. Referral promo. |

a. Free plan has ads which can be distracting. b. Overwhelming interface for non-finance users. |

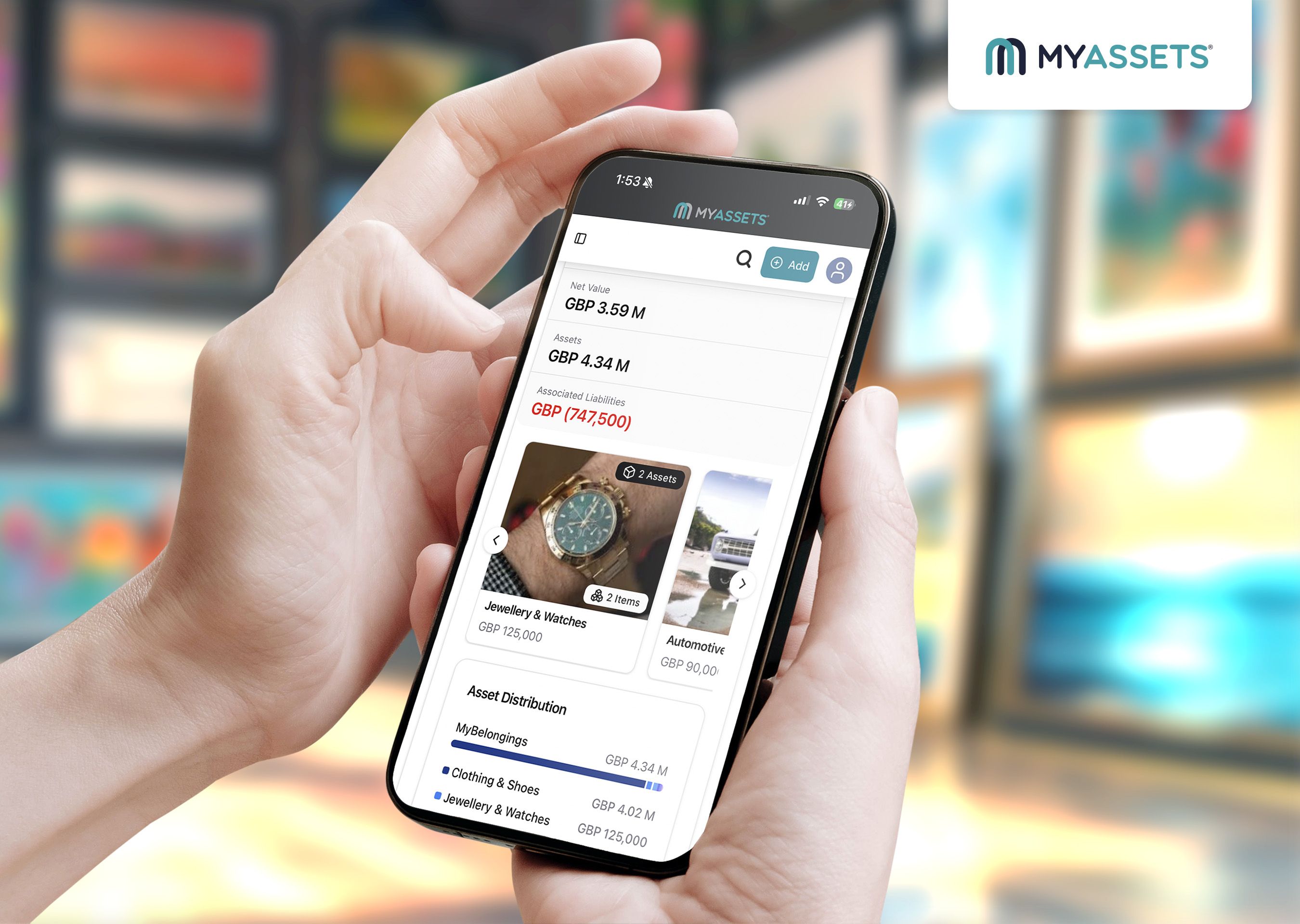

| MyAssets | An asset management software that streamlines tracking, organising, and managing assets in one platform. It accommodates diverse assets including cash, properties, art, collectables, everyday items and other unique assets. | Investors, collectors, and high net worth individuals (HNWIs). | $25/month $250/year |

14 days | a. Consolidates many types of assets from finances, and properties, to collectables and belongings. b. Can import asset data in bulk. c. Gives control over user-level access to information. |

a. Information overload with all your assets. b. Unique assets may require some time to add details. |

| Betterment | A robo-advisor that helps individuals and businesses with cash management. | People interested in investing (cash, stocks, or crypto) in a robo-advisory way. | $4/month | None | a. Includes retirement planning. b. Offers tax loss harvesting auto sell holdings (experiencing a loss to help offset taxes). c. Access to human advisors. |

a. No direct indexing. b. Available in the US only. |

| Kubera | A wealth management app that allows you to monitor your investments and overall financial health. | DIY Investors, high net worth individuals, and cryptocurrency investors. | $150/month | 14 days for $1 | a. Low advisory fees. b. Includes tax management features. c. A daily email providing an overall portfolio update. |

a. No mobile app. b. Insufficient analysis capabilities. |

| Empower | An online financial advisor and personal wealth management company. | High-net-worth investors and hands-off investors. | 0.49%-0.89% management fee. $100,000 account minimum. |

None | a. Access to a team of financial advisors. b. Personalised retirement planning. c. Advanced tax optimisation strategy. |

a. Limited transaction management and budgeting. b. Lack of credit health information. |

| Buildium | An all-in-one property management software that allows real estate professionals to manage property portfolios, including leasing, accounting and operations. | Property managers, real estate, homeowners, vendors, and tenants. | $55/month | 14 days | a. Provides learning resources to maximise the usability of the platform. b. Automate property listing, entering and depositing payments, etc. c. Print checks for you remotely. |

a. Difficult to use at first. b. Limited customisable reports. |

| Asset Panda | A cloud-based asset relationship management platform that helps you keep track of your devices and create interdependencies between them. | Small businesses, mid-size businesses, and large enterprise. | 500 assets for $1,500/ year | 14 days | a. Easy-to-use software for someone who is not tech-savvy. b. Mobile barcode scanning function. c. Great. customisation and replication feature. |

a. A minor lag is observed when loading assets and configuration pages. b. Lack of intuitiveness in terms of setting up advanced configurations, device linking, etc. |

| Asset Tiger | An asset tracking software that streamlines maintenance scheduling, barcode scanning, expiration tracking and more. | Freelancers, small businesses, mid-size businesses, and large enterprise. | 500 assets for $120/year | Free for 250 assets | a. Enables the creation of a regular schedule in line with the demands of the assets. b. Mobile barcode scanning function. c. Check-in and check-out feature that allows you to track the progress of assets as they move through each step. |

a. Lacks multi-factor authentication feature for account security. b. Lack of API or integrations with other products. |

| Itemtopia | An iventory app for cataloguing valuables and collections, which allows you to organise items of everything you own. | Individuals, collectors, freelancers, and small businesses. | $6/month for 3-month offer | Free version | a. Allows you to organise and manage all your items from home to business in one place. b. Ability to customise fields for various asset types. c. Link items to a status enabling you to see items if they are for replacement, selling, repair, and such. |

a. No data import/export option. b. Lack of third-party integration. |

| CatalogIt | An application that is designed to catalogue and manage collections anywhere. | Museums, personal collectors, organisations, consultants, conservators, and artists. | $12.50/month | Free for 50 entries | a. The system is easy to learn and use regardless if you are a beginner or an expert. b. Populate and navigate your collection with ease c. Smooth importing process. |

a. The wide variety of collections can lead to irrelevant categories for some collectors, causing potential data entry clutter. b. Lacks document printing (i.e. accession, deaccession, and loan documents). |

Why Do You Need an Asset Management Software?

Having a digital tool or comprehensive system that can handle asset management is beneficial especially if you have an extensive collection of assets that can no longer be managed manually.

Below are a few reasons why you should consider switching to an automated asset management system:

- Automate processes like data entry to reduce potential data inaccuracies.

- Easily identify investments that yield profitable returns or sudden declines.

- Enhance decision-making by providing accurate and interpreted data.

- Expedite cataloguing and managing of records.

- Give you an overview of asset valuation: purchase costs, current value, associated gains or losses.

- Improve reliability in your overall workflow.

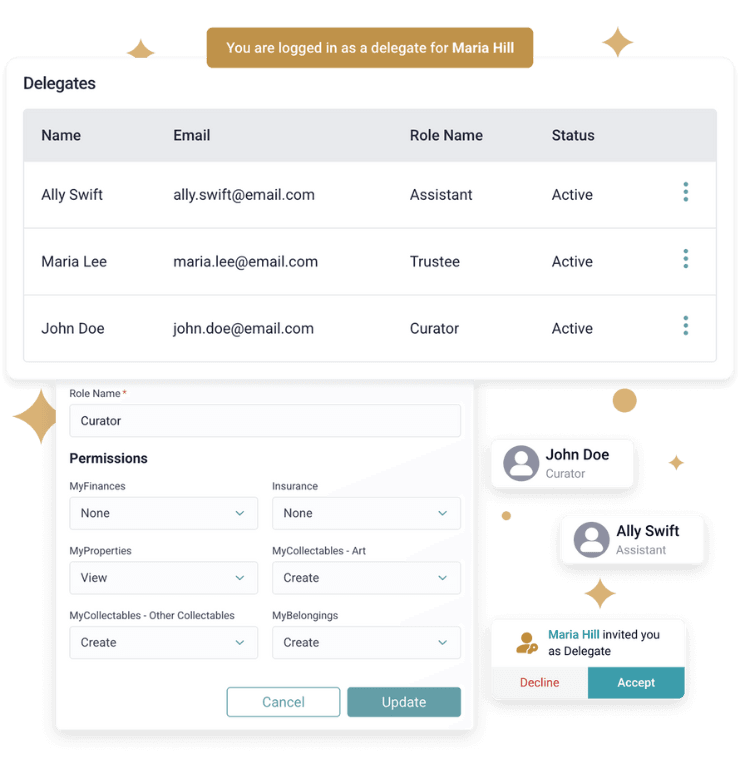

- Provide accountability through the designation of user access and permissions for owners or beneficiaries.

Key Features to Look For in an Asset Management Solution

Finding the right software that aligns with your requirements can be tough when there are various tools available in the market.

Below are important software features you should look for when choosing your asset management solution.

Tracking Asset Location

One of the most convenient features offered by the best asset management software is the ability to record information about your assets. The following information may include location, status, acquisition cost, and other relevant details associated with your asset.

Imagine trying to find a piece of art from your collection; having an asset management software that allows you to indicate where each piece of your collection is stored would come in handy.

Not to mention having access to important documents such as authenticity certificates and insurance policies is convenient as information is readily available when needed.

Access to Report and Analytics

When choosing among various wealth management platforms, make sure it has built-in analytics and a feature to export reports.

A software comparison, Comapresoft notes that data analytics and visualisation help you make quick decisions about your finances, property, or other investments. Additionally, such software facilitates identifying issues when it comes to asset replacement, disposal, or retention.

Reports also provide information to evaluate performance metrics, allowing you to assess your financial standing.

Asset Security

A secure and trustworthy platform is a must when you own a large volume of assets. When selecting software, check advanced features that allow you to set user permissions –restricting access from unauthorised users.

Why do you need to assign access to your assets? Suppose you want to grant access to a family member like your mother. You want to make sure she can see where particular assets are located.

However, you do not want her to make any edits or change any of the fields you have encoded in the system. Instead, you want a different user, say your brother, to manage all asset-related updates. This can be tricky if your tool only allows the same level of permissions across all asset owners.

On the other hand, the ability to set, restrict, or update permissions promotes accountability and protects your data from any unwanted changes, giving you complete control over asset management.

See More: MyAssets: The Digital Asset Management App That Get Things Done

Before You Purchase An Asset Management Application

Before you purchase an asset management application, it is important to consider several key factors. Listed below are the following checks to make:

The Tool Meets Your Requirements

What are your reasons for using an asset management system (AMS)? What types of assets do you want to manage? After answering these basic questions, make sure to list down your specific requirements or “must-haves.”

Not all software solutions are equipped to meet a wide set of demands. Some software as a service specialises in financial accounts. Others boast advanced features streamlined for collectables. Identifying your specific needs enables a targeted search for services that align with your objectives.

The Product is Scalable

Picking among one of the top asset management solutions is a big decision and also a big investment on your part. Keep in mind that as you start to grow your wealth, your finances, properties and collections will progressively expand, as highlighted by a software company, Hudutech.

For instance, if you plan to add several investments within a year, your asset manager tool should have a built-in capability to track not just physical assets, but other types as well. This will save you time and cost from migrating to a new software.

In this sense, the adaptability of your chosen software should accommodate this growth.

The Software Has Positive Reviews

Similar to buying items on Amazon, it is common practice to review user feedback before finalising your purchase.

According to the magazine Maintworld, reading reviews is a good way to evaluate an asset management software’s performance. Look for specific comments about how the software matches a user’s intended function or how well it fits your expectations. Reviews also help you gauge overall customer satisfaction.

Also Read: The Best Household Management Software for Organising Furniture and Assets

Ready to Choose Your Asset Management Solution?

In light of the wide variety of asset-tracking solutions available, the best way to narrow down your options is to identify your specific requirements or “must have” application features, checking if the tool can handle your growing portfolio, and doing due diligence when it comes to examining the software’s features, limitations, and current user reviews.

This informed approach guarantees that your chosen asset management tool not only fulfils your current requirements but also adjusts seamlessly to your future investment plans.

There are several challenges when assets are mismanaged. This includes overlooked financial losses and underutilised assets. Asset management solutions can help reduce these challenges by providing tools for tracking, organising, and optimising asset utilisation.

Automated Asset Management: Frequently Asked Questions

1. What is the best asset management software?

Asset management software is a platform designed to record and track assets throughout their lifecycle from acquisition to disposal.

It provides users with vital information about their valuable items or properties including location, status, or who is responsible for each, among other things. While there is no single “best tool”, there will always be a best tool for you, one that fits your business or individual needs.

2. What is an example of asset management?

An example of asset management is overseeing a £400,000 investment in technology stocks and regularly reviewing the performance of individual stocks like Apple and Microsoft.

This includes relocating funds based on market trends, and providing quarterly performance reports to ensure investment aligns with financial goals.

3. What are the benefits of using asset management software?

An asset management software or system improves operational efficiency via features such as generated insights into the location and status of your assets. This minimises the risk of loss or theft, while streamlining asset organisation and resource optimisation.

Manage Assets as Unique as Your Needs with MyAssets

As digital asset management software becomes more prevalent, it is now your responsibility as a user to determine which option best suits your needs.

If you are looking for a solution to manage everything from finances and properties to collectables and personal belongings, a tool like MyAssets is the ideal choice.

MyAssets is a complete management platform that enables you to track and manage everything you consider valuable, all in one place.

For MyAssets, specifically, its intuitively designed web and mobile platform simplifies asset management by providing a platform that consolidates assets as unique as your needs.

This centralised system allows for seamless monitoring of your portfolio and easy access to important documents.

Simplify the asset management process with MyAssets' comprehensive platform. The platform can be explored in detail at app.myassets.com.