Imagine walking through your home and realising that your household items – from your smartphone and sofa to your kitchen appliances – are collectively worth more than a brand-new luxury car.

According to Aviva’s 2025 How We Live report, the United Kingdom's average value of household possessions has soared by 38% over the past five years, now exceeding £58,000. This rise is not just a reflection of inflation but also a shift in how and where people are spending their money.

Much of the increase is driven by technology and quality upgrades: the average value of personal devices (e.g. laptops, tablets, and mobile phones) has risen by 48% from £3,506 to £5,196.

Millennials lead the trend, owning significantly pricier possessions. Their average tech value is £8,267 (over £3,000 more than the national average), and their jewellery is worth around £8,233—about £2,500 higher than average.

As household items grow in value, the line between “possessions” and “investments” begins to blur. This makes it more important than ever to evaluate when household items become assets, differentiating between true assets and expenses.

For example, there are seven household categories worth investing in, not only for monetary value, but also for comfort, efficiency, and long‑term well‑being:

- Air purifiers – Clean air for people with allergies and pet owners can be physically beneficial.

- Art collection – Aesthetic and expressive, art can increase in value over time with thoughtful curation.

- Comfortable chairs and recliners – Enhance productivity and comfort, and quality range products can last five to 10 years.

- High‑quality mattress – Improves sleep, health, and durability.

- Premium cookware set – High‑end tri‑ply stainless cookware ensures lasting performance and cooking enjoyment.

- Security camera system – Boosts home safety and peace of mind; can integrate smoke detection.

- Smart thermostat – Remote home heating control saves on energy bills via smarter temperature management.

These items may not deliver financial returns like stocks, but they offer tangible benefits such as improved health, lower utility bills, increased comfort, and long-term durability. As household items balloon to £60,000 in value, it's good to shift perspective: these items are not incidental purchases but can be meaningful investments in our daily lives.

This article helps you identify assets at home and understand the value of your household items. More importantly, it also delved into how tools such as MyAssets can help you organise and track your valuables.

- Understanding Household Items as Assets

- Personal Assets from Household Items: What Qualifies?

- Practical Guide: Household Asset Checklist

- Household Inventory Value: Why It Matters

- Examples of Household Assets You Might Be Overlooking

- How to Organise and Manage Your Home-Based Assets

- How to Use MyAssets to Organise and Manage Valuable Household Items

- Seeing Everyday Items as Assets: Frequently Asked Questions

Understanding Household Items as Assets

According to the Office for National Statistics (ONS), household wealth in Great Britain comprises four main components.

- Net financial wealth - The value of financial savings and investments, once liabilities have been deducted.

- Net property wealth - The value of owned properties, once outstanding debt has been deducted.

- Physical wealth - Includes tangible possessions like vehicles, household belongings, and collectables.

- Private pension wealth - Accrued occupational and personal pension entitlements (excluding state pensions).

Since household items (e.g. furniture, electronics, household items) are classified within physical wealth, the question arises: Can they be considered assets?

Because household items have monetary value and contribute to your net worth, even though they may not be easily liquidated, they can be counted as part of physical wealth and considered as assets.

What Makes Something an Asset?

In personal finance, assets encompass anything you own that contributes to your net worth, either by generating income, growing in value, or holding resale value.

Personal assets can include:

- A home and land – These are tangible, fixed assets that often appreciate over time.

- Artwork – Collectables that often increase in rarity and worth over time.

- Belongings – Electronics, furniture, or other personal items that are less liquid but still possess monetary value.

- Financial accounts and securities – Liquid assets (e.g. savings, stocks, mutual funds) can generate income through interest, dividends, or capital gains.

- Jewellery – Physical items that may appreciate or retain value.

Together, these resources represent current or non-current tangible and intangible assets that contribute to your overall wealth.

Identifying Assets at Home

At a deeper level, some assets are intangible, imbued with sentimental value even if they don’t necessarily hold significant financial worth. Family heirlooms, keepsakes, and intergenerational pieces in your home carry emotions, stories, and heritage that far exceed their resale value. So while these items may not deeply impact your financial net worth, they certainly hold meaningful personal value.

Organising and maintaining family heirlooms involves thoughtful steps such as building a detailed catalogue, which allows you to include item descriptions, materials, measurements, provenance, condition, and photographs to preserve history and clarity for future generations. You can also display or repurpose heirlooms, bringing these treasures into everyday life and honouring their origins. For example, draping an antique quilt over a sofa or turning a vintage teacup into a jewellery holder.

In this way, while sentimental assets may not always translate to monetary value, properly cataloguing, caring for, and integrating them as functional or decorative pieces ensures they remain living parts of your and your loved ones' legacy.

Personal Assets from Household Items: What Qualifies?

Household assets typically fall into two broad categories: tangible assets and intangible assets.

Tangible assets include physical items you can touch and value. This includes your home and land, cars, furniture, appliances, and other personal belongings.

Meanwhile, intangible assets are non-physical yet valuable resources like intellectual property, digital media, or accrued rights, though these are less common in typical household net worth calculations.

Understanding what makes something an asset within your home, whether tangible or intangible, gives a clearer picture of your household’s overall net worth. By cataloguing physical possessions alongside less visible intangible rights, you can more accurately assess your financial standing and make better-informed decisions about wealth, insurance, and legacy planning.

Can Furniture Be an Asset?

Furniture can indeed be considered an asset if its current value exceeds the original purchase price. Just note that in some countries, there may be different qualifiers or standards for whether furniture can be considered as assets. For example, by the United States legal and accounting standards, common household furniture isn’t typically classified as an asset. The IRS defines assets as items that hold value and generate income, such as stocks, bonds, or rental properties.

Since most furniture depreciates and usually doesn’t produce income, it’s often excluded from formal asset definitions in legal contexts, especially everyday pieces like dining tables and chairs.

Differentiating Assets vs Liabilities for Household Items

A household asset is something valuable that you own or generate income from, such as a home, savings, or investments. In contrast, a liability is an obligation you owe, such as a mortgage, car loan, or credit-card balance. Your assets can come with associated liabilities that allow you to get an accurate calculation of your overall net worth.

For example, your house is an asset, but if you have a mortgage, that debt is a liability. Similarly, a car loan offsets your vehicle’s asset value. Calculating your household’s net worth gives you a clearer picture of financial health. By accurately identifying and quantifying both sides of the balance sheet, you can assess your real financial position and plan accordingly.

Appreciating Household Items: What Gains Value Over Time?

Appreciation is the increase in an asset’s value over time, while depreciation is the decrease in value. Although sentimental household items can carry deep emotional significance, only a few truly appreciate in financial value. Most everyday possessions experience wear and tear and lose value over time.

However, select well-maintained items can appreciate significantly. For example, antique rugs, especially hand-woven Oriental pieces in excellent condition, are highly sought by interior designers and collectors. Similarly, mid-century furniture has surged in popularity and market value among collectors. Fine china, when complete and in pristine condition, also commands increasing prices as vintage patterns become rare. Additionally, vintage toys and video games (e.g. rare Furby models, Polly Pocket sets, and first‑edition NES games) frequently sell for hundreds or even thousands of dollars if boxed and intact.

In contrast, most household items, such as standard kitchen appliances or mass-produced furniture, depreciate due to ageing, usage, or obsolescence.

Knowing which items appreciate versus depreciate can greatly aid in decluttering sentimental items. Recognising the potential value of items clarifies which sentimental possessions to keep, sell, or donate. This awareness helps you make informed decisions, balancing emotional attachment with financial practicality. By distinguishing appreciating household items from depreciating goods, you can streamline your household belongings and even turn treasure into opportunity.

Read also: How to Style Your Home Like an Art Gallery

Practical Guide: Household Asset Checklist

The first step to identifying your household assets is to build a comprehensive home inventory. Start room by room, cataloguing each item by entering details such as acquisition date, description, serial numbers, and photographs. This enables comprehensive asset tracking, ensures an accurate financial overview, supports insurance claims, assists with estate planning, and helps in prioritising asset protection.

A detailed home inventory also facilitates calculating your net worth and understanding your credit health, which can help you gain clarity on your real financial standing and credit decisions. When you log each household asset (e.g. property, furnishings, or electronics), you capture a snapshot used in net worth formulas.

Building a robust home inventory does more than organise belongings; it forms the foundations of your household’s financial management. From presenting clear records for insurers and heirs to empowering you with precise data for net worth and credit applications, it's a vital tool for long-term wealth and financial stability.

Household Inventory Value: Why It Matters

Understanding the true worth of your possessions gives a clearer view of your overall wealth. Household assets often make up a significant portion of personal wealth. Including their value ensures that your net worth reflects all tangible assets, not just financial accounts like savings or investments.

Managing physical assets at home starts with creating a personal inventory that records details like the item’s type, make, model, value, location, and purchase date. Organising assets into clear categories, such as by type or room, helps with easier tracking.

It’s also helpful to implement a digital system to keep the inventory accurate and easy to update. Supporting documents like receipts, appraisals, or warranties should be stored securely. Regularly reviewing and updating your inventory ensures your records stay current.

These steps help provide a more complete and organised picture of your tangible wealth, supporting better financial planning, insurance claims, and estate management.

Examples of Household Assets You Might Be Overlooking

Typically, household assets that significantly increase in value over time are those that earn “collectable” status thanks to their rarity, provenance, or age.

These are some examples of collectables you may find in your home:

- Antique furniture - High‑quality pieces crafted by known artisans often become more valuable with time.

- Artwork - Original paintings, limited-edition prints, or sculptures, can appreciate in value depending on the artist’s reputation and collector demand.

- Collectables - Vintage toys, rare books, coins, stamps, or trading cards can also gain considerable financial worth when maintained in excellent condition.

To help manage such appreciating household assets, organising collectables with intention can enhance their preservation and value. Carefully catalogue each piece with descriptions, acquisition dates, condition reports, and provenance. Then you can categorise them by type (e.g. coins, toys, art) and use a digital inventory system to keep records organised and accessible.

It’s also important to use proper storage methods and perform regular inspections to monitor the condition and address any deterioration early. By systematically organising and maintaining collectables, you safeguard their value, support accurate valuation, and help ensure they remain meaningful household assets.

How to Organise and Manage Your Household Assets

MyAssets stands out as the ideal app for organising your life and managing your household assets, offering a centralised platform that supports comprehensive organisation, clarity, and cohesion. By enabling users to consolidate financial, digital, and physical assets, MyAssets helps build a rich inventory of household items to facilitate efficient tracking and management

Unlike traditional spreadsheets or scattered paper records, MyAssets allows you to organise, track, and manage all types of household items in one secure, centralised platform. You can build a detailed and searchable inventory by uploading descriptions, photos, purchase details, valuations, receipts, and other essential documents.

A key feature of MyAssets that enhances the organisation of household items is its Address Book. This allows users to connect specific contacts, such as family members, service providers, or insurance agents, to individual assets. By linking the right person to the right item, you can easily track who owns, manages, or is responsible for each household asset. This is especially useful for large households or families sharing responsibilities.

The Address Book also provides a centralised view of asset and contact information, so you can quickly retrieve details about an item and see who is connected to it. Whether it's knowing who handles appliance maintenance or who is listed as a beneficiary for a valuable item, this feature simplifies organisation. It ensures that every household item is properly accounted for, supported, and easily managed, making day-to-day household admin efficient.

See More: How To Integrate Your Address Book And Assets Into One App

How to Use MyAssets to Organise and Manage Valuable Household Items

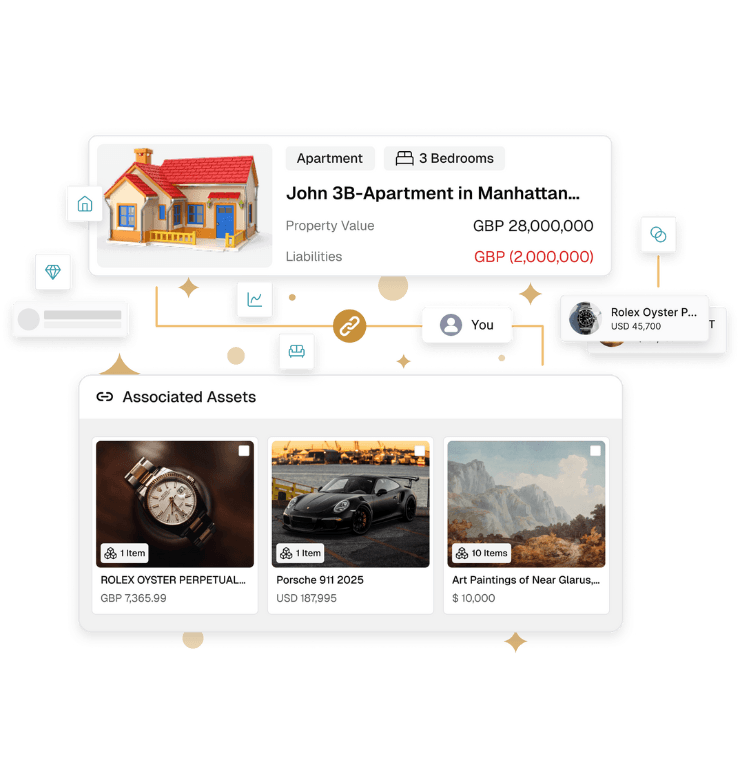

MyAssets offers a comprehensive platform for tracking and managing personal wealth, with a strong emphasis on organising household assets. Its expansive features divide assets into four key categories: MyFinances, MyProperties, MyCollectables, and MyBelongings—the latter specifically tailored to household items like furniture, electronics, and family heirlooms.

This detailed categorisation allows users to record each asset’s value, location, and supporting documentation, creating a complete inventory essential for estate planning, insurance claims, and personal finance management.

The platform’s Smart Asset Linking feature further enhances its utility by showing how different asset types connect, linking household items to properties, or tagging ownership across family members. This interconnectivity provides you with a holistic view of your net worth, highlighting the cumulative impact of everyday possessions. By treating household assets with the same care as financial or real estate holdings, MyAssets empowers you to understand and manage your valuables efficiently.

Seeing Everyday Items as Assets: Frequently Asked Questions

1. Can everyday items really increase in value over time?

Appreciating household items typically has qualities of “collectables” in terms of provenance, age, rarity, and condition. For example, original art by renowned artists, vintage toys, and rare books.

2. When does a household item become an asset?

Various considerations must be taken into account, including the item’s financial value, usability, resale potential, and appreciation.

3. What qualifies as a household asset?

Examples of key criteria for household assets include monetary value, ownership, and durability.

MyAssets: Recognising Household Items as Assets

MyAssets is a powerful platform that helps you organise, track, and manage your household assets with ease. From electronics and appliances to antique furniture and collectables, MyAssets allows you to categorise, document, and assign value to each item.

Its intuitive features make it simple to link assets to rooms, people, and supporting documents, offering a clear picture of your belongings and their contribution to your overall net worth.

Ready to assess if your household items are assets? Whether it's a vintage guitar or antique furniture, knowing what you own and what it’s worth can help grow your net worth. Start your MyAssets 14-day free trial today.