Stepping into the art world can be challenging due to its complex and inaccessible nature. According to The New York Times, galleries often evaluate potential buyers, while famous artists maintain waitlists, making it difficult for newcomers to acquire pieces.

Given these challenges, collectors may sometimes employ art advisors to help them get access to highly demanded works or to artists that are not typically available to clients, according to The Orange Advisory.

While the art advisor’s profession may seem indefinite to many, this article will break down the key responsibilities of art advisors and other considerations that collectors must make before hiring one.

- The Role of Art Advisors in the Art Market

- Qualifications of an Art Advisor

- Benefits of Hiring an Art Advisor

- The Cost of Hiring an Art Advisor

- Finding the Best Art Advisors

Who are Art Advisors?

Grove Gallery defines art advisors as art experts who assist clients by offering information about the artworks they are interested in while providing impartial advice. They guide clients throughout the acquisition process, ensuring the selected pieces align with their desired collection vision.

In addition to offering valuable insights, New York-based art advisor Maria Brito explains that these art experts act as a vital link between collectors and various galleries, leveraging their connections to increase the collector's chance of acquiring sought-after pieces.

Art Advisor vs Art Consultant

Sibu Gallery notes that the primary distinction between an art advisor and an art consultant lies in their area of focus.

Art advisors specialise in growing art collections with a strong focus on investment. Their role typically involves guiding clients in acquiring high-value pieces, utilising their deep understanding of art, artists, and prevailing market trends.

In contrast, an art consultant focuses on specific projects, often bringing expertise in interior design or styling. They are skilled at designing project layouts with their strong sense of aesthetics, spatial awareness, and a complete understanding of the client's vision.

Ultimately, understanding an advisor's responsibilities is key to selecting the right professional who can effectively meet artists' or collectors' specific needs.

What You Need to Know About Art Advisors

The role of an art advisor extends far beyond recommending pieces. This section delves into their specific responsibilities as well as several must-have qualifications.

1. The Role of Art Advisors in the Art Market

According to Artelier, the role of an art advisor varies depending on the requirements of every client.

For private collectors, art advisors facilitate selecting or buying pieces that reflects their taste. They may also offer guidance on framing, lighting, and displaying artworks.

For art investors, art advisors offer appraisal services and act as auction specialists to ensure strategic purchases.

Responsibilities of an Art Advisor

While their core strengths lie in art expertise and sourcing skills, they also take on the following additional responsibilities, as referenced in Art Investments UK:

- Analyse market trends

- Conduct research

- Determine art authenticity

- Negotiate on behalf of clients

- Present art proposal

- Visit galleries, art fairs, museum shows, and artist studios

2. Qualifications of an Art Advisor

Given the need for expertise in the art world, an art advisor should ideally possess relevant education and practical job skills to support their role effectively.

Education

Artelier shares that art advisors often hold a Bachelor’s or Master’s degree in fine arts, art history, or a related discipline.

These programs, such as those at the University of the Arts London, often include subjects like curatorial studies and art conservation at the undergraduate level; meanwhile, postgraduate degrees offered by Sotheby’s Institute of Art delve deeper into topics like art business planning, collection building, and art selection and acquisition.

Job Skills

Sotheby Institute notes that an art advisor must be an attentive listener, capable of grasping the unique preferences and objectives of their client. Their role is to prioritise the client’s aesthetic vision over their own.

Moreover, a strong understanding of business principles and the art market is essential to navigate the complexities of acquisition. Since acquiring artwork is a financial transaction, an advisor must evaluate market value, verify pricing, assess quality, and document provenance. Negotiation skills are also essential to secure favourable terms.

3. Benefits of Hiring an Art Advisor

Whether a collector is purchasing their first piece or looking to expand an existing collection, hiring an art advisor offers multiple benefits that a self-guided approach could miss.Streamline Acquisition Process

The HLK Art Group emphasises that an art advisor's role goes beyond simply making recommendations.

Advisors conduct thorough research to assess and pre-select artworks that meet specific criteria. By providing a curated list of options, they streamline the selection process, making it more efficient for the client to acquire an art collection.

Access Exclusive Opportunities

Art advisors maintain well-established connections with artists, galleries, and auction houses, granting clients access to exclusive artworks, private viewings, and events as stated by Turning Art.

This level of access opens doors to sought-after pieces while saving costs on high-value acquisitions that would otherwise be difficult to secure independently.

Manage Portfolio

Art advisors act as strategic partners, offering active collectors a personalised solution for curating and managing their portfolios.

Beyond evaluating artworks' financial potential and market value, they identify opportunities to refresh, diversify, or strengthen a collection by addressing gaps or suggesting new acquisitions.

This guidance aligns with the collector’s goals –whether on aesthetic appeal, cultural significance or investment value.

4. The Cost of Hiring an Art Advisor

Before hiring an art advisor, it is essential to understand the costs involved so as to correctly allocate funds. Below are the common types of fees involved when hiring an art advisor:

Commission-Based Fee

As reported by Art Investments, art advisors commonly charge commission-based fees, typically ranging from 5% to 20% of the artwork’s sale price. The rate may vary depending on the advisor’s experience and the artwork’s value.

Hourly Fee

Alternatively, some art advisors charge by the hour, with rates typically determined by their expertise, reputation, and location. With entry-level advisors, they charge less than £100 per hour, while more experienced professionals charge higher rates.

Retainer Agreement Fee

According to Modern Contemporary Art, a retainer agreement is a fee to secure the advisor’s ongoing services. Clients who regularly buy or sell art or require ongoing collection management typically pay a retainer fee.

Generally, retainer fees range between £1,500 and £10,000 per month, depending on the services offered and the level of support needed.

5. Finding the Best Art Advisors

Finding the best art advisors is often challenging, especially for collectors without a clear starting point. Listed below are resources to simplify the search process.

Professional Directories

Professional directories are structured listings that provide information about individuals, organisations, businesses, or services, often including details about their professional lives, education, and training, as referenced in Budibase.

The Association of Professional Art Advisors is a prime example of a professional directory focusing on art consulting and collecting services. This directory allows users to filter their search by art media, specialisations, services offered, and the geographic regions served.

Art Advisory Platforms

Top art advisors are also found on art advisory platforms such as Artelier, a leading art consultancy platform that provides expert guidance to clients in the art market.

Artelier offers various services, including artwork development and management, project management, investment advice, personalised contemporary art collections, market research and more.

Do You Need an Art Advisor?

A report from Art Basel highlights remarkable growth in the art market, with sales increasing from $39.5 billion (£31.6 billion) in 2009 to $67.8 billion ( £54.2 billion) in 2022.

This substantial expansion has driven the growing demand for art advisory services as collectors seek expert guidance to navigate the flourishing market effectively. Moreover, as the art market continues to thrive, the role of art advisors becomes increasingly indispensable.

Understanding their qualifications, the benefits they bring, and the associated costs empowers collectors to make informed decisions when engaging in their services.

Art Advisory: Frequently Asked Questions

1. What is the job of art advisory?

Arterlier notes that art advisors offer professional guidance to individuals or institutions for developing and maintaining their art collections over a long period of time.

2. Do I need an art agent?

For individuals who recognise the challenges of managing everything independently or feel that their art collecting journey has reached a plateau, engaging the services of an art agent may provide the professional expertise needed to advance to the next level, according to a website builder for artists, Format.

3. What is the difference between an art advisor and an art consultant?

According to SIBU Gallery, an art advisor typically offers long-term guidance on building, managing, and investing in an art collection, focusing on aesthetic and financial aspects.

In contrast, an art consultant provides specialised advice for specific projects, such as selecting artworks for a particular space or event, without the broader, ongoing relationship that an advisor usually maintains.

Consolidate Art Contacts In One Platform Through MyAssets

Alignment is essential when clients engage with art advisors. The client and the advisor must have a shared understanding of the client's goals and preferences, ensuring that the advisor's recommendations and strategies effectively meet those needs.

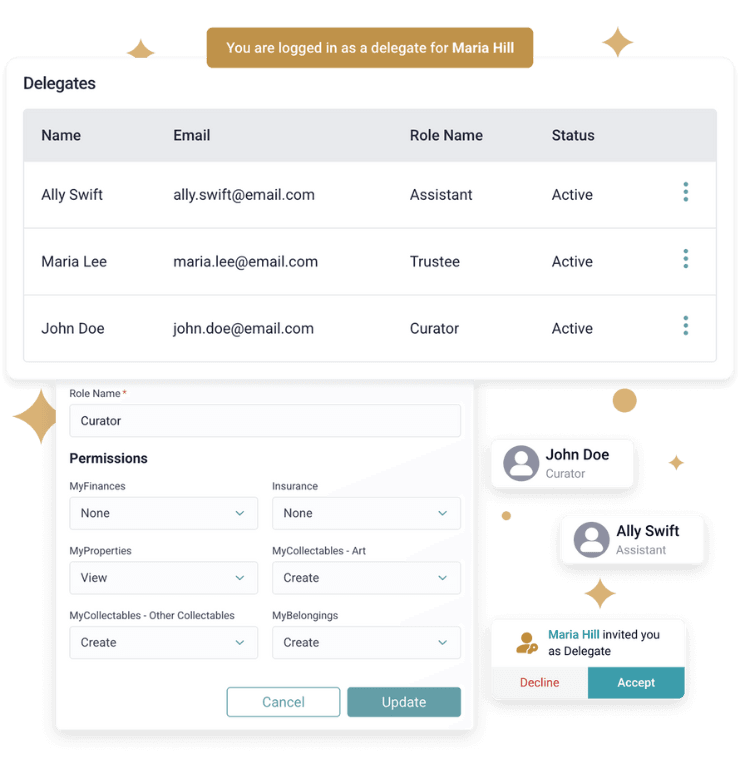

By leveraging tools like MyAssets, collectors can opt to share their digital collections with their trusted advisors by delegating access to them. Collectors can also consolidate all of their art contacts in one centralised database, facilitating smoother communication and a more streamlined approach to managing their collections.

MyAssets is a complete asset management platform that allows users to catalogue their artwork's details, including title, artist name, and provenance; one can even add notes for additional context.

With MyAssets, users can categorise their art collection into styles, mediums, themes, artists, or other criteria for easy data retrieval.

Interested? The platform can be explored in detail at app.myassets.com.