Net worth isn’t just about how much money you have in the bank, but the full picture of your financial standing. It includes everything you own and owe. That might be a checking account at Barclays for daily spending, a savings account at Ulster Bank for emergency fund, a 401(k) for future retirement, and a mortgage with Lloyds Bank as a first home.

When your finances are spread across multiple accounts, you're actually using a smart strategy to grow your net worth called “diversification.” But with that comes complexity — juggling different apps, logging in and out of portals, and struggling to see your complete financial picture at a glance.

It is no surprise that 78% of consumers now expect to see all their financial data in just one place, according to finance company MX.

This is where net worth aggregators come in. These tools consolidate all your financial information from bank accounts and savings to pensions and investments, into one easy-to-read dashboard. The result? Instant clarity, better control, and simplified money management.

Instead of logging in multiple times, this app acts as a financial aggregator, pulling and synthesising data from all your financial accounts for seamless tracking and management of wealth.

Struggling to keep track of all your finances? This article explains what a net worth aggregator is and how it simplifies tracking money. More importantly, it highlights some of the best financial account aggregators, their must-have features, and why they might be the perfect fit for you.

- What is a Net Worth Aggregator?

- How Financial Aggregators Work

- Key Features to Look for in a Net Worth Aggregator App

- Best Financial Aggregator Tools

- Wealth Aggregator: Keeping All Your Finances in One Clear View

- Aggregator in Wealth Management: Frequently Asked Questions

What is a Net Worth Aggregator?

A Net Worth Aggregator is a digital tool that collects and consolidates financial data from various sources, such as bank accounts, investment portfolios, credit cards, cryptocurrencies, and loans, into a single, unified dashboard.

By bringing all this information together, a net worth aggregator app performs the calculation of: Net Worth = Assets - Liabilities automatically.

This provides a comprehensive overview of a person's complete financial situation, enabling users to track their cash flow, analyse their financial health, and ultimately gain an accurate and holistic snapshot of their wealth at any given moment.

Net Worth Aggregator vs. Budgeting App

This raises the question: how do net worth aggregators differ from traditional budgeting apps? The distinction lies in their purpose and time horizon. Budgeting apps focus on short-term cash flow and daily spending, while net worth aggregators offer a long-term perspective such as tracking assets and liabilities to build lasting wealth.

In this sense, if one’s priority is monitoring their daily expenses and cutting back on spending based on the given data, a budgeting app is the ideal choice, as it is designed for granular, short-term cash flow control.

Conversely, for those planning with a long-term outlook, whether for retirement, buying property abroad, or financial independence, a net worth aggregator app is more suitable, as it focuses on the long-term growth and alignment of total assets and liabilities with financial goals.

Benefits of a Financial Account Aggregator

Here are the key advantages of using finance aggregator apps:

- Complete Financial Visibility: Aggregates all bank accounts, credit cards, investments, and other assets in one place, providing a 360-degree view of an individual’s financial health.

- Efficient Data Consolidation: Eliminates the need to log into various bank and investment accounts by consolidating data into one platform.

- Measurable Goal Setting: Enables users to track progress towards their financial goals by providing a transparent view of their assets, liabilities and overall net worth.

See also: 4 Easy Tips To Secure Your Future Financial Success

How Financial Aggregators Work

Net worth aggregators or financial account aggregators link to multiple financial accounts (bank accounts, investment portfolios, credit cards, and loans) to consolidate data into a single, centralised dashboard.

This integration delivers a real-time overview of an individual’s financial position, simultaneously computing their net worth. The process can be summarised in four main stages:

1. Account Linking

The user connects their various financial accounts (banks, brokerages, credit cards, loans) to the aggregator software, as noted by Finra. The wealth aggregator then uses application programming interfaces (API) or encrypted connections to establish a read-only link to these institutions.

2. Data Collection

Once connected, the wealth aggregator continuously or periodically collects real-time financial data, including account balances, recent transaction history, and current market value of investments and other assets (i.e., real estate). It also allows users to input and update values manually.

3. Net Worth Calculation

The net worth app then processes the collected data by adding up the total value of all assets and deducting the combined amount of liabilities. The result is the user’s net worth, which can either be a positive net worth (indicating financial stability) or a negative net worth (signalling potential financial challenges).

4. Data Presentation

Finally, the calculated net worth and all aggregated financial information are presented to the user through a single dashboard. The platform often includes visual aids, such as charts, spending reports, and investment analysis features, to easily track financial progress and make informed decisions.

Key Features to Look for in a Net Worth Aggregator App

The primary goal of a net wealth calculator is to deliver a unified and precise view of one’s financial position. Therefore, it is relevant to select an app with features that support this function, such as:

Robust Account Connectivity

A net worth aggregator app is primarily defined by its ability to securely link to diverse financial channels to pull and compile a user's complete financial data. To make this possible, the single most crucial feature is account connectivity, which links the platform across the user’s entire financial life, from checking accounts and mortgages to investment portfolios.

The shift toward modern API connections is a major selling point for financial account aggregators, as highlighted by Talk Fintech. This technology enhances data accuracy through real-time balance updates while maintaining strong security via read-only access to account information.

Read more: FinTech and Financial Literacy: How Technology is Changing Money Management in the UK

Data-Driven Dashboard

The primary function of a net worth aggregator is to pull large amounts of data from numerous financial sources. As a result, a dashboard feature is proven essential, as it allows users to understand this aggregated data at a glance.

But what exactly is a dashboard? According to the visual analytics platform Tableau, it is a central display that compiles various types of visual data. Its purpose is to present diverse, yet interconnected, information, typically using charts, graphs, tables, and other visualisation tools in one place.

Imagine sifting through spreadsheets and custom reports. With a dashboard, most vital data will be placed up front, saving users the time to analyse data.

Diverse Asset Monitoring

Net worth calculation requires the value of both financial and physical assets (such as property investments and art collections) that may appreciate, alongside any associated debt or financing incurred during their purchase.

To achieve comprehensive aggregation, the best financial aggregator must have a feature for monitoring diverse assets. This is typically accomplished through a manual entry option within the platform, allowing users to track unique or illiquid items, such as jewellery, vehicles, or specialised collectables.

Best Financial Aggregator Tools

Are you starting to feel the hassle of monitoring multiple bank accounts, investments, and credit cards?

Here are some of the top financial aggregators that can bring all your net wealth in one place.

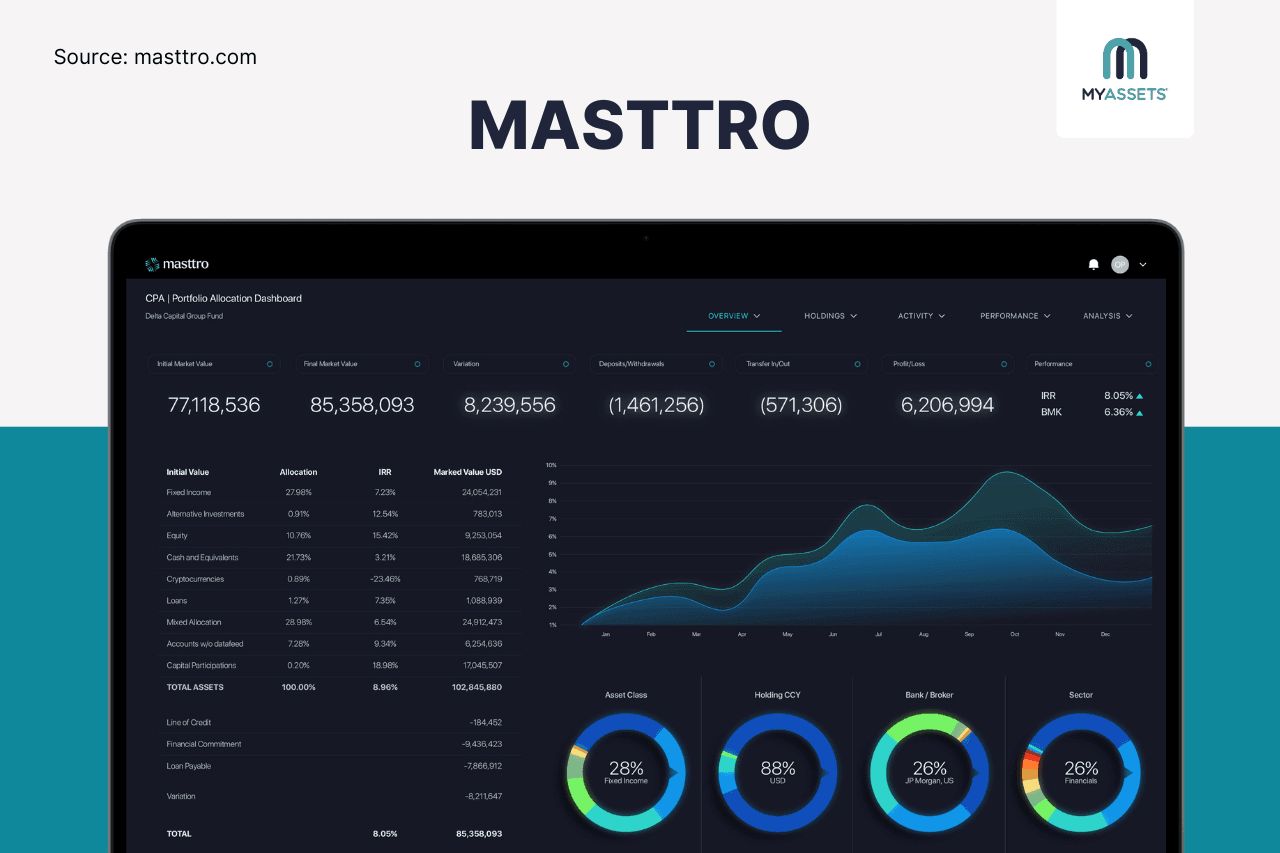

1. Masttro — For Ultra-High-Net-Worth Individuals Managing Wealth

Masttro is a financial aggregator designed for ultra-high-net-worth individuals and family offices, offering a complete view of family wealth and assets.

Covering everything from investment and brokerage accounts to checking, credit card, and loan accounts—as well as alternative assets like real estate and collectables—this software summarises financial information into a highly visual dashboard.

Pros

- Connects directly to over 600 networks of custodians and banks globally, providing comprehensive coverage of financial information.

- Utilises Artificial Intelligence (AI) through its Document AI feature, which automates data extraction from capital calls and distributions, reducing manual workload.

Cons

- Some features are in ongoing development as the platform continues to mature.

- The flat-rate pricing approach is ideal for large enterprises but may present higher relative costs for smaller or growing family offices.

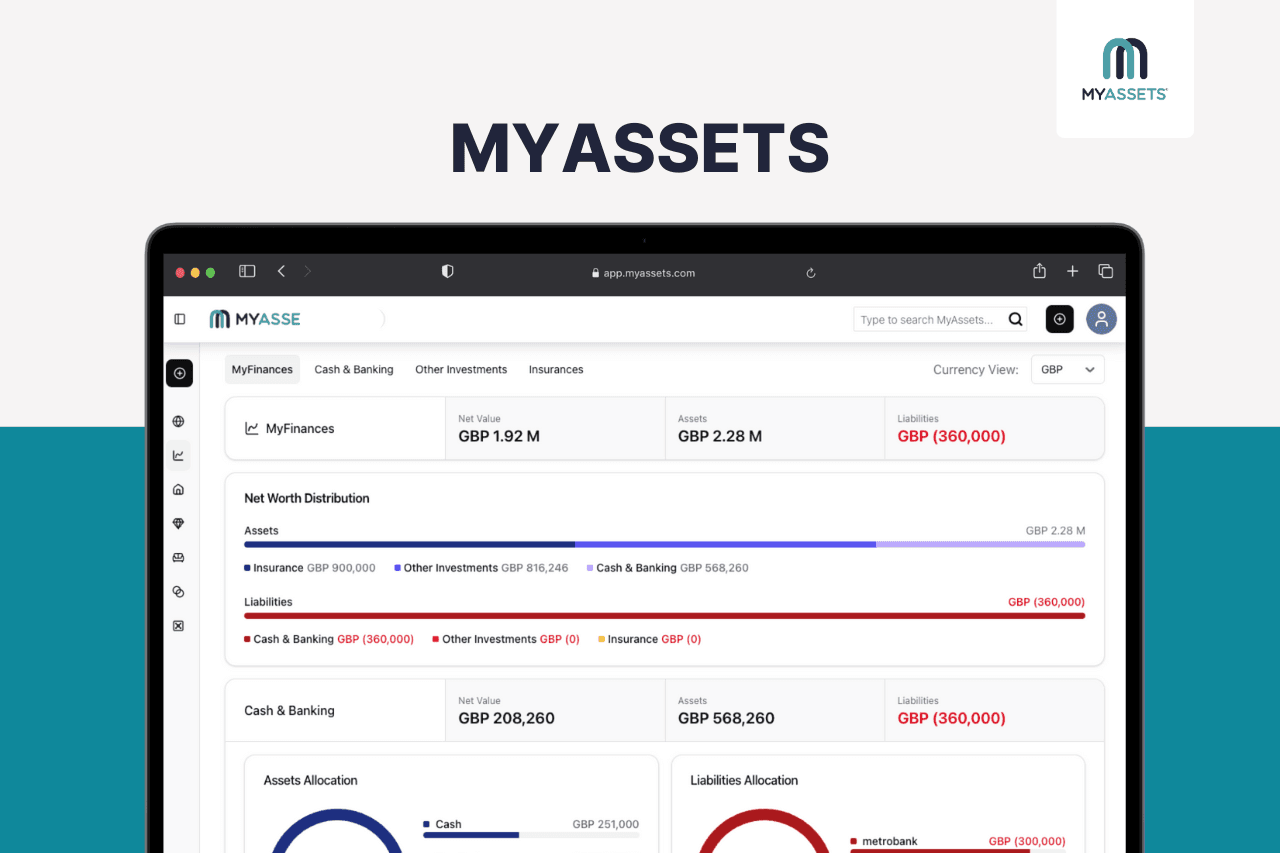

2. MyAssets — For Individuals Pursuing Diverse Asset Monitoring

MyAssets is an asset management platform that powerfully functions as a net worth aggregator. It consolidates a user's liquid assets by connecting directly to various financial institutions and allowing for manual input. This includes tracking all cash and banking accounts, such as current, savings, multi-currency, credit cards, and loans.

Beyond these typical financial accounts, the platform integrates traditional investments, insurance policies, and even physical assets—such as real estate and collectables—all within one organised dashboard.

Pros

- Integrates with top brands, including Plaid, Stripe, One Schema, and Artfacts for seamless asset management.

- Offers Smart Asset Linking feature, helping users understand how various assets—from finances and real estate to collectables and personal holdings—interact and influence their net worth.

Cons

- Certain features are under active development, suggesting steady advancement and future potential.

- While initial setup requires some effort, the benefits of streamlined tracking follow quickly.

Read more: MyAssets: The Digital Asset Management App That Get Things Done

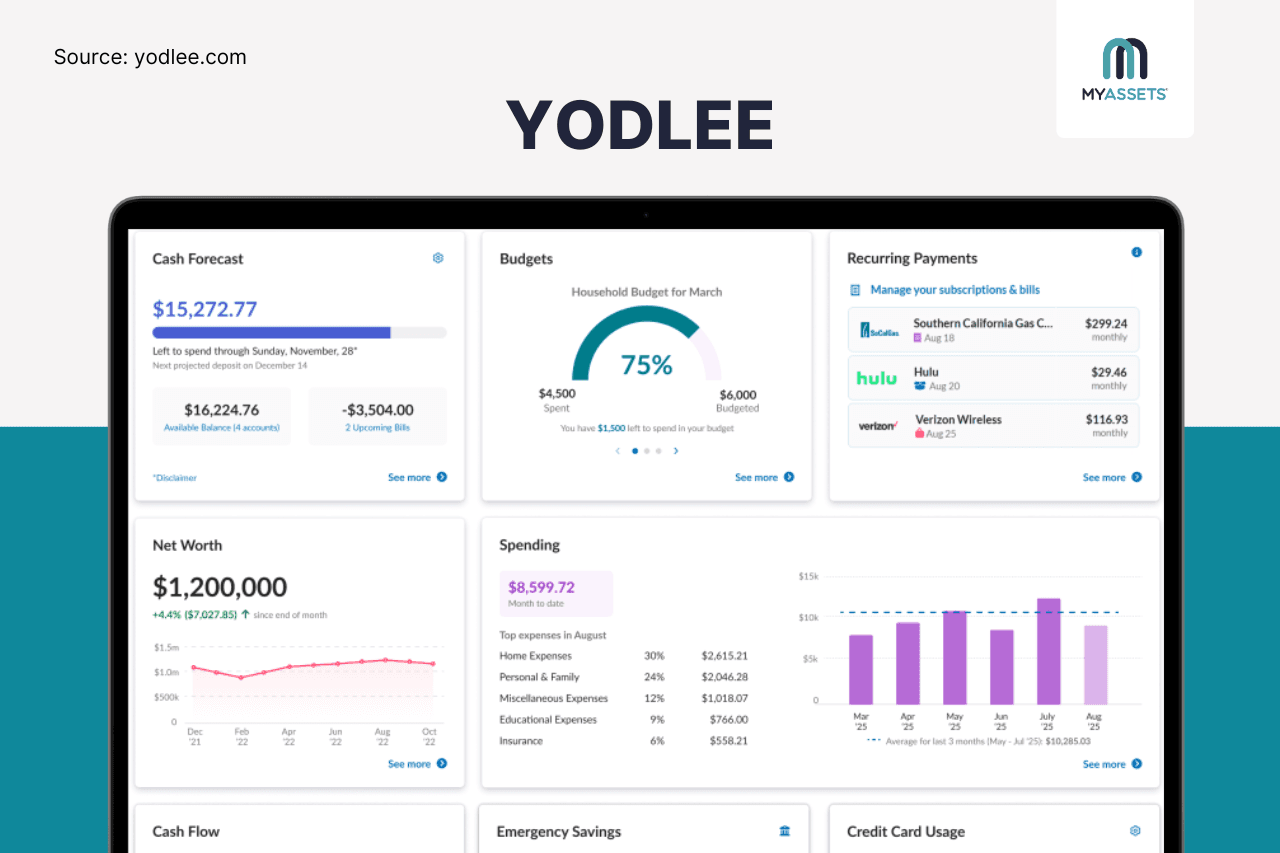

3. Yodlee — For Enterprise Wealth Tracking and Management

As one of the leading financial aggregator companies, Yodlee collects information from disparate sources and unifies it, offering users a comprehensive view of their finances. This aggregation solution is essential to banking and wealth monitoring operations, as it enables users to generate insights into spending habits and other key behaviours.

Ultimately, the platform equips its users with the high-quality, real-time data needed to deliver personalised advice and drive strategic next-best actions.

Pros

- Integrates with more than 20,000 financial institutions and global providers for enhanced international reach.

- Leverages consumer-permissioned data to create secure, data-driven financial experiences that promote trust and innovation.

Cons

- Its enterprise-level design can add a layer of complexity that isn’t always ideal for specific users.

- Pricing is available only upon request through the sales team, making evaluation less straightforward.

Wealth Aggregator: Keeping All Your Finances in One Clear View

In wealth monitoring, an aggregator plays a crucial role in transforming fragmented financial data into a unified, actionable view. Understanding the account aggregator meaning goes beyond simple account linking. It involves creating complete financial visibility that supports smarter goal setting and decision-making.

Whether through tools like Masttro, MyAssets or Yodlee, the best personal finance aggregator offers seamless connectivity, diverse asset tracking, and intuitive dashboards that simplify complex financial lives.

By integrating an aggregator in wealth management, individuals gain not just a clear snapshot of their net worth but the insight needed to manage, plan, and grow it with confidence.

Aggregator in Wealth Management: Frequently Asked Questions

1. What is an example of a net worth aggregator?

MyAssets, Empower, and Monarch Money are direct-to-consumer net worth aggregators, while Masttro serves as a wealth management platform offering a net worth calculator tailored for family offices. Yodlee functions as a financial data aggregation platform designed for businesses.

2. What is the best net worth tracker?

The best net worth tracker depends on individual needs, though Empower and Monarch are often rated among the top choices. MyAssets is another strong contender, delivering robust and diverse asset monitoring.

3. What is the minimum net worth for account aggregator?

The minimum net worth requirement for an account aggregator depends on the software. Some platforms require none at all, making them accessible to individuals at any financial level. Others, particularly those tailored for high-net-worth clients, may set a threshold.

Unlock a Better Understanding of Your Finances with MyAssets

Cash at one bank, debt at another?

Stop playing guesswork with your financial standing. MyAssets is a net worth aggregator that consolidates financial data — from cash and bank accounts to investments and insurance policies — into one place.

The MyAssets Global Dashboard goes beyond tracking bank accounts, summarising wealth across all asset categories and transforming complex data into clear, visual reports. MyAssets enables users to accurately track everything they consider an asset—whether cash, properties, art, collectables or other valuable belongings.

Need help gathering data from bank accounts?

MyAssets simplifies the process by utilising bank integration tools to automatically sync and update account balances, with the option for manual updates when needed.

It gets even better —MyAssets and its partner bank aggregators use Advanced Encryption Standard (AES 256) and Transport Layer Security (TLS), two of the most robust encryption protocols available, ensuring top-tier security for all financial data.

For collaboration, MyAssets excels. It allows users to add delegates—such as financial advisors or accountants—while maintaining security through custom access controls. Specific permissions (View, Edit, Create, or Delete) can be granted to ensure tailored access and full oversight.

Take the first step toward smarter wealth tracking — try MyAssets free for 14 days.