Are you guessing your way through wealth management? Overseeing assets by instinct is a definitive recipe for confusion and missed opportunities. As the esteemed management expert Peter Drucker stated: "You can't manage what you don't measure."

Those who neglect to monitor their net worth, asset allocation, and performance are not truly managing their wealth but are merely observing it unfold. This inaction is precisely the problem that modern fintechs aim to solve.

The Journal of Economic Psychology further emphasise that individuals who regularly track progress toward a financial goal, such as checking bank balances, tend to adjust their behaviour, like cutting back on discretionary spending. Financial awareness gained from these tools then increases their likelihood of reaching those goals.

Fintech, as a vehicle for financial literacy, has brought to life the best wealth tracking apps to empower investors with the most granular financial information. These apps aggregate nearly all assets onto a single dashboard, making it easier to calculate net worth and drive informed financial decisions.

If you are looking for the perfect app to track your wealth, this post highlights key features to look for and a list of the best wealth monitor apps to help manage your wealth.

- Key Features to Look for in a Wealth Tracking App

- 7 Best Wealth Tracking Apps Investors Should Know

- Comparative Table of the Best Wealth Monitoring Apps

- Monitor, Manage and Grow with The Best Wealth Tracker App

- Best Wealth Monitor App: Frequently Asked Questions

Key Features to Look for in a Wealth Tracking App

Choosing the right wealth tracking app goes beyond convenience. It is about finding the right features that give a clear picture of finances by consolidating all investments.

Below are the essential features to consider when choosing the best wealth tracker app.

Financial Account Integration

Account integration is the ability to connect and pull financial data (i.e., bank accounts, credit cards, investments) from various sources into a single platform. For instance, if a user links their checking account to a net wealth calculator, the app gains access to their bank transactions.

The real value of this feature lies in its ability to replace time-consuming, error-prone manual entry. In fact, research from the finance company MX reveals its impact, with 29% of consumers having already consolidated multiple financial accounts into one app.

Net Worth Tracking

According to Schwab Moneywise, the purpose of tracking net worth is twofold: it provides a snapshot of one’s financial standing and establishes a benchmark for monitoring progress towards financial goals.

This leads to the question: How does net worth tracking work? This functionality performs the core calculation for users: Net Worth = Total Assets - Total Liabilities.

It does this by automatically aggregating and accounting for all assets (i.e., cash, bank accounts, traditional investments, properties) and liabilities (i.e., mortgages, loans, credit balances) linked or added by the user to the platform.

At its core, this functionality moves past tedious manual calculations and allows users to focus entirely on strategising and taking action to increase their net worth.

See also: How to Calculate the Liabilities Associated with Your Assets on MyAssets

Visual Reporting of Finances and Investments

Beyond basic tracking, a crucial feature for any finance app is data visualisation, which transforms complex financial data into easily digestible reports.

This is achieved by providing easy-to-understand visual tools, such as:

- Line graphs to monitor the trajectory of net worth and investment performance over time.

- Pie charts and bar graphs to break down wealth distribution across various asset classes (e.g., finance, property, collectables).

The benefit of this visual approach is measurable efficiency. A study by Pratama and Pratiwi (2022) found that applying visualisation to financial reports reduced the time required for analysis from 80 seconds to less than 60 seconds (a reduction of over 25%), confirming its significant impact on the speed and clarity of financial management.

7 Best Wealth Tracking Apps Investors Should Know

Juggling multiple accounts and investments can feel like a full-time job. That is where a wealth tracker app comes in. It brings all assets together in one dashboard for a clearer view of finances.

Here are some of the best wealth tracking software worth checking out.

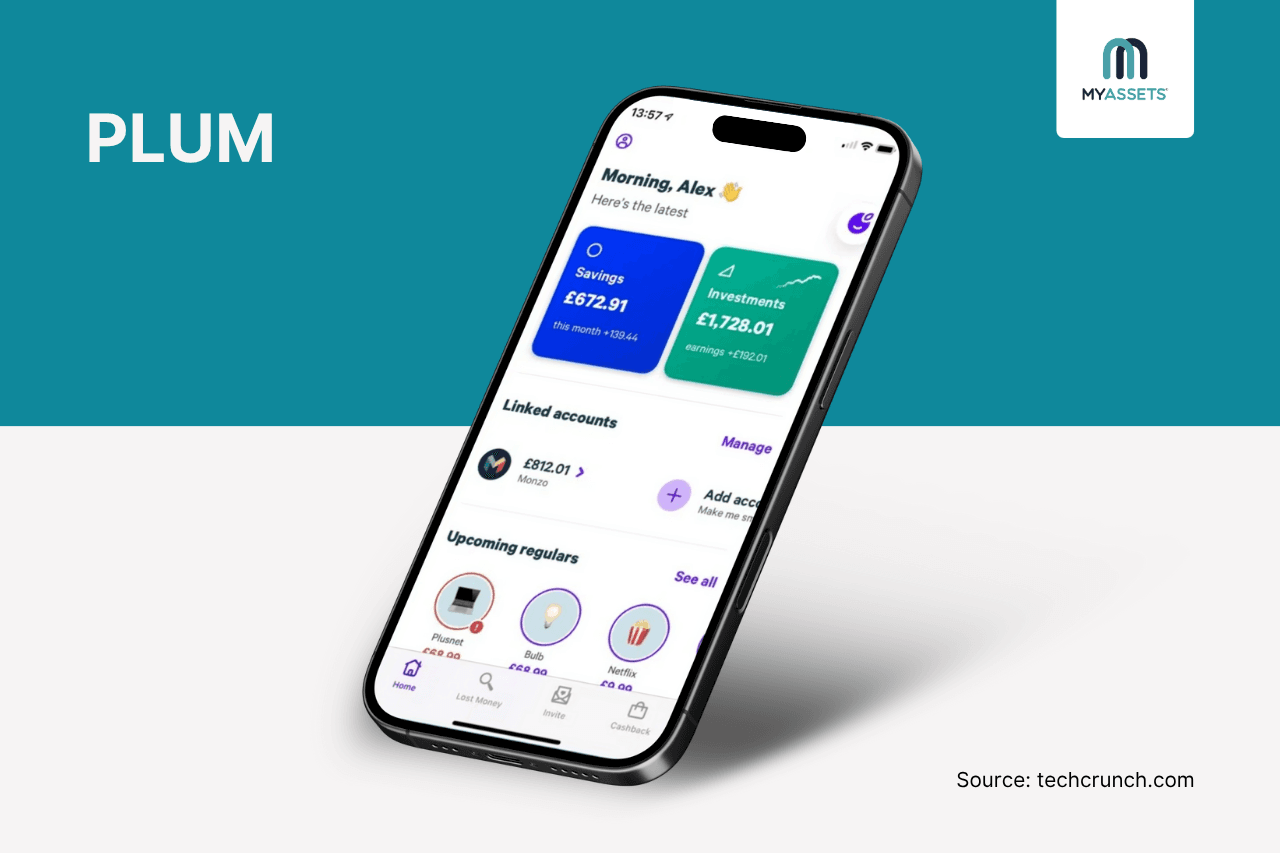

1. Plum — For Saving and Investing

Plum, as a wealth monitoring tool, links bank accounts via Open Banking to help users understand their finances. Its AI tools then analyse spending patterns and offer personalised insights to help users manage their money more effectively.

Pros

- Allows users to allocate cash into an easy-access savings pocket, earning up to 3.20% - 3.84% AER.

- Offers an investing platform that enables users to access over 1,200 stocks through various tax-efficient accounts, including Stocks and Shares Individual Savings Account (ISA), General Investment Account, and Self-Invested Personal Pension (SIPP).

- Supports account integration with major UK banks, including Halifax, Barclays, and HSBC, and also allows linking credit cards to accounts.

Cons

- A feature-heavy setup could feel overwhelming to particular users. While it has a lot to offer, this can also lead to confusion or difficulty in navigating the app.

- Those with limited portfolios or who stick to the basic tier might find the combined monthly and investment fees hard to justify.

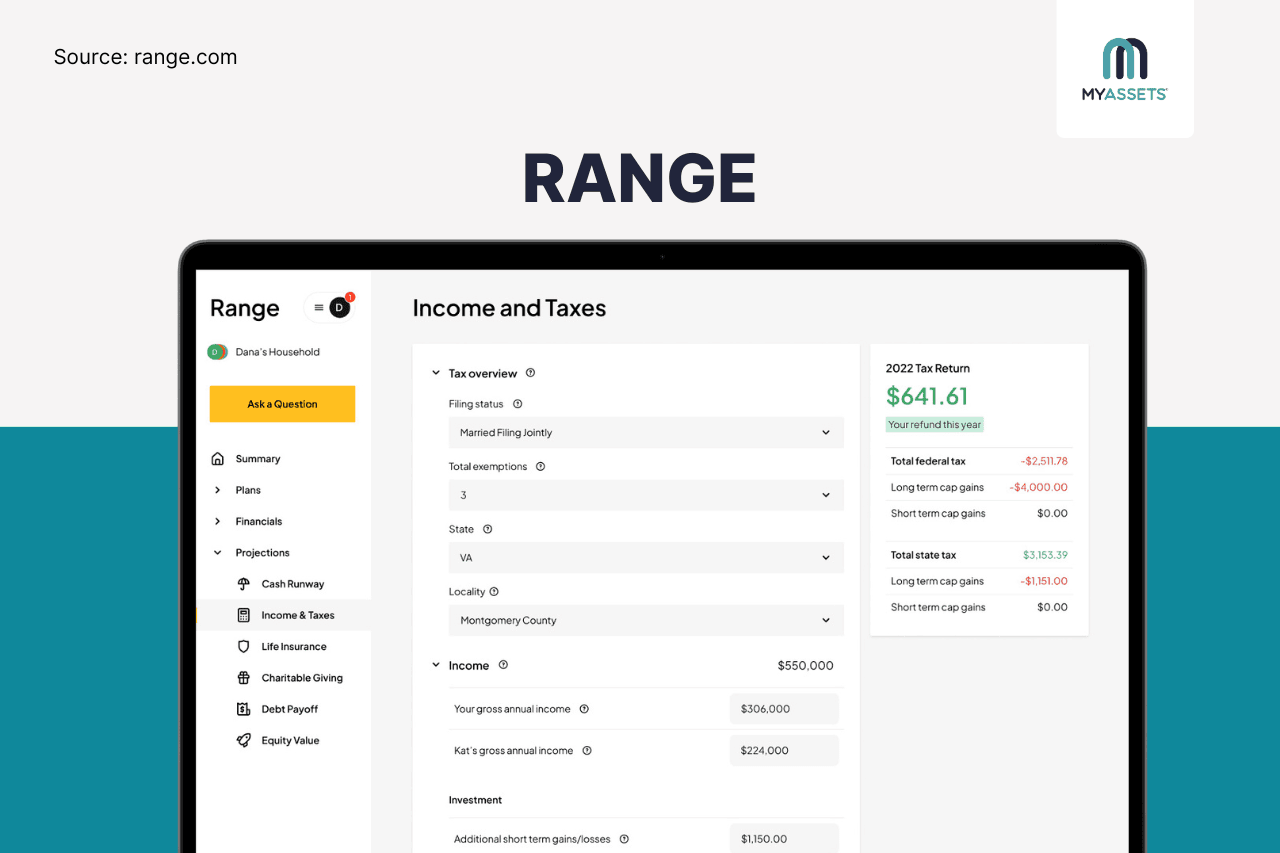

2. Range — For Managing Significant Wealth

Range is a wealth management platform that caters to high-net-worth individuals by centralising financial information in a single platform. Often referred to as a billionaire app, the platform integrates a range of services for these individuals—including investment management, tax planning, retirement planning, and cash flow analysis.

Pros

- Blends human expertise with AI, where financial professionals review finances, while AI streamlines the process.

- Offers estate planning services by evaluating existing documents and reviewing beneficiary designations for seamless asset transfer, while also calculating cash flow projections and handling complex multi-state tax planning for letting property.

- Provides DIY planning tools and dashboards, enabling users to run projections, track budgeting goals, and monitor their finances in real time.

Cons

- Supports users residing in the United States only.

- Target high earners, making tools and features costly for those with simpler financial profiles.

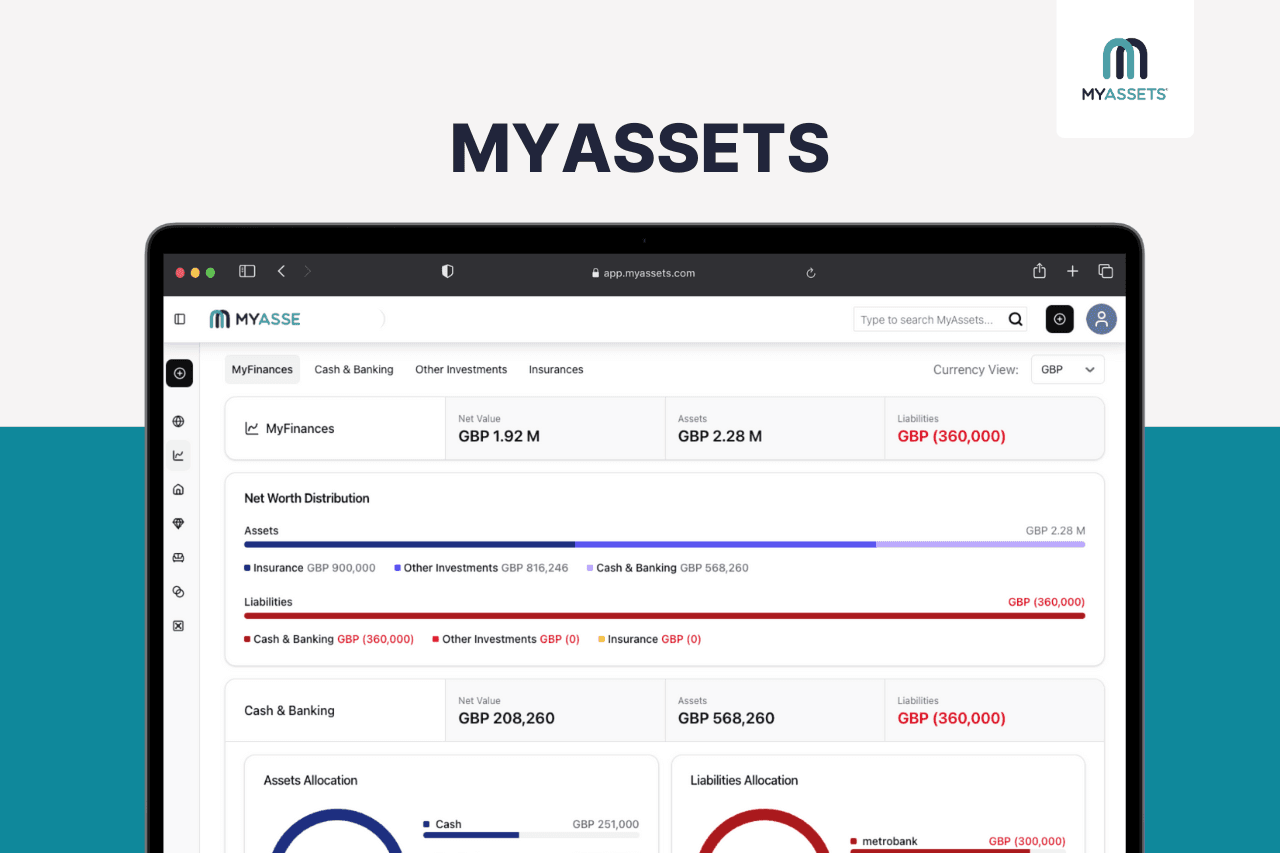

3. MyAssets — For Organising Diverse Assets

More than a net worth tracker app, MyAssets delivers robust features that allow users to centralise and organise diverse assets.

Just like other Software as a Service, MyAssets delivers features for logging all forms of wealth, including finances, properties, collectables and belongings. Once assets and liabilities are recorded, it automatically performs the net worth calculation, providing users with a comprehensive view of their financial standing.

Pros

- Allows users to link related assets together like a home, its mortgage, and associated art collections under one property record.

- Organises wealth into four silos: MyFinances, MyProperties, MyCollectables, and MyBelongings—ensuring every asset is neatly classified.

- Provides a clear snapshot of overall assets, liabilities, and net worth through a Global Dashboard, enhanced with visually engaging charts that illustrate asset distribution.

Cons

- New users could encounter an adjustment period due to the platform’s rich functionality.

- While the mobile app is still in development, MyAssets remains accessible on both desktop and mobile via web browsers.

Read more: MyAssets: The Digital Asset Management App That Get Things Done

4. Vyzer — For Tracking Complex Portfolios

Vyzer is a wealth tracking app that serves as a central hub for managing complex portfolios. It consolidates a user’s financial picture—covering traditional assets like bank and brokerage accounts, as well as harder-to-track holdings such as real estate, private equity, and business ventures.

Pros

- Connects with multiple investment accounts, including brokerages and banks, and also supports manual entry or document uploads for private and alternative assets.

- Enables users to measure their performance against peers and discover opportunities anonymously.

- Handle intricate portfolios beyond the scope of average investors, offering strong value to serious and high-net-worth users.

Cons

- The free starter plan is limited in features, assets, and account capacity, requiring users with complex portfolios to upgrade to a paid tier.

- While users can view and assess their complete portfolio, trading and transactional functions are not available.

5. Exirio — For Multi-Currency Portfolio Tracking

As a core function, Exirio tracks diverse global holdings, encompassing traditional assets (stocks, ETFs, and cryptocurrency) and non-traditional investments (real estate and luxury items), all of which are managed across 40+ currencies.

Pros

- Allows controlled sharing by granting partners or advisors view or edit rights, plus emergency access for a trusted contact.

- Connects with numerous banks and crypto platforms to automatically track all investments in one unified hub.

- Moves beyond simple balance tracking to provide in-depth portfolio analysis, such as Time-Weighted Return (TWR), Money-Weighted Return (MWR), realised or unrealised gains, and currency exposure.

Cons

- Dedicated exclusively to wealth and investment tracking, without personal finance features such as spending tracking or budgeting tools.

- Requires extensive data entry during setup to input and manage all assets and investments.

6. Quicken — For Budgeting and Managing Finances

Widely recognised as a budgeting tool, Quicken truly shines as a wealth tracker software. It centralises all financial data, allowing individuals to monitor budgets, investments, spending, and bills in one place.

Across its three available plans, users benefit from core features such as savings tracking, a 12-month budget planner with proactive suggestions, and the convenience of downloading account information.

Pros

- Let's users handle payment tracking and processing without leaving the app.

- Offers robust transaction management with flexible, accurate, and automated categorisation for income and expenses.

- Provides interactive tools to set savings goals, plan long-term finances, reduce debt, and track taxes, with results displayed in graphs and reports.

Cons

- The full desktop version of the application offers significantly more features than its limited companion mobile and web apps.

- Some sections of the interface give a slightly outdated impression compared to modern apps.

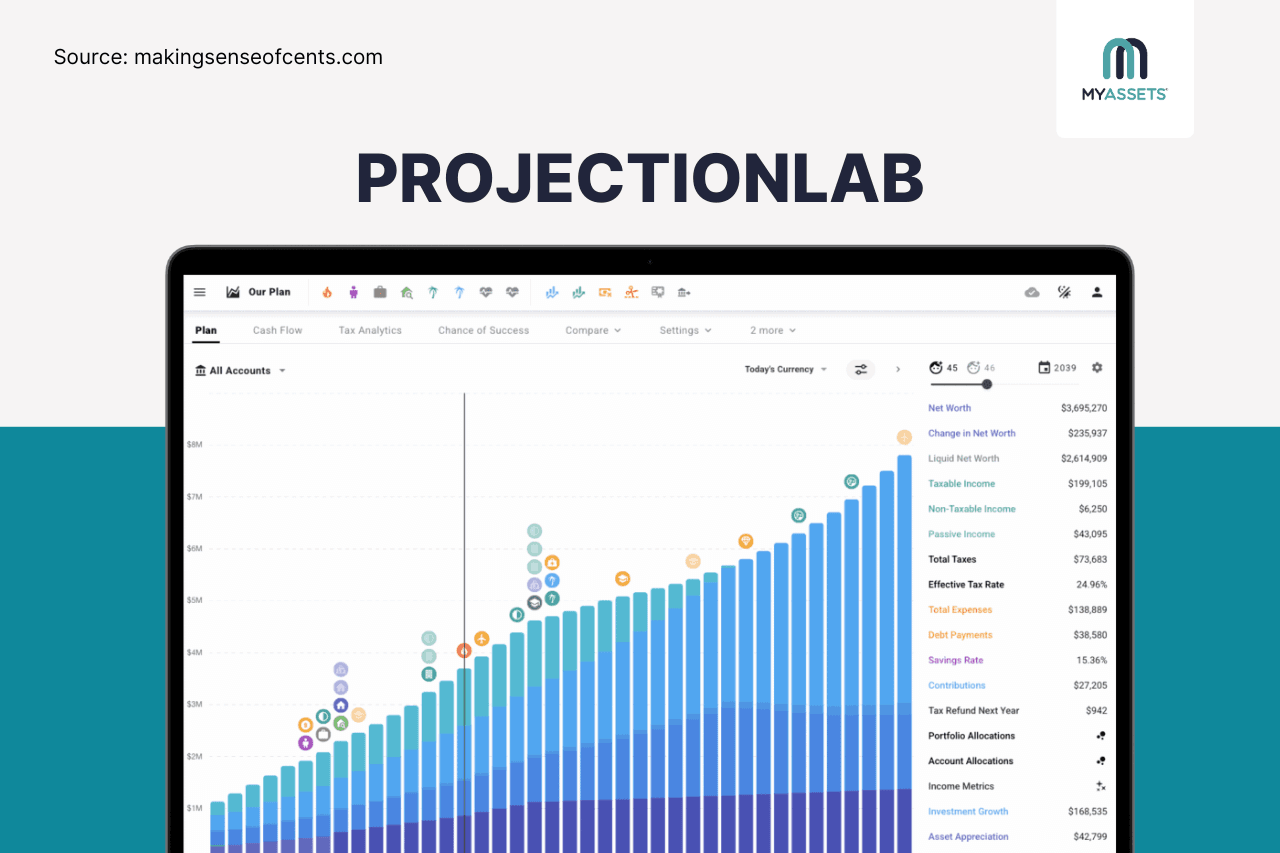

7. ProjectionLab — For Financial and Retirement Planning

Moving beyond simple monitoring, ProjectionLab functions as a financial simulator that empowers users to master long-term planning mechanics.

Users input their current and projected financial data to determine when they will reach goals, like financial independence or retirement. Crucially, the tool allows individuals to easily modify inputs and assumptions, enabling scenario analysis to account for real-world contingencies and life changes.

Pros

- Features cash flow visualisations using Sankey charts alongside tax impact analysis for a deeper understanding of finances.

- Let’s users compile income, expenses, savings, and debt into a thorough, year-by-year financial model.

- Offers scenario-testing features that help users evaluate how different financial strategies—like shifting asset allocations, modifying retirement contributions, or modelling Roth conversions—might affect their financial future.

Cons

- Bank accounts cannot be linked, which can be time-consuming to set up and update.

- Accessible only via desktop, limiting on-the-go access.

Comparative Table of the Best Wealth Monitoring Apps

Choosing the best wealth tracker app depends on the user's financial complexity and goals. The table below compares some of the best wealth monitor apps, highlighting best-fit user, availability of a free version, trial period, and starting price to help find the best app fit for their needs.

| Application | Best For | Free Version | Free Trial | Starting Price |

|---|---|---|---|---|

| Plum | Individuals looking for a combination of money management and investment platforms. | Yes | 30 days | £3.99/month |

| Range | High-net-worth individuals seeking a unified platform for investments, taxes, estate planning, and more. | No | No, but it does offer a free demo. | $1,475/semi-annually |

| MyAssets | Individuals seeking to organise, track and manage their assets –from finances and properties, to collectables and belongings. | No | 14 days | $25/month |

| Vyzer | Investors, family offices and investment advisors who handle diverse and complex portfolios. | Yes | No | $145/month |

| Exirio | Self-directed investors and individuals searching for a centralised view of their diverse portfolio. | Yes | No, but it does offer a free demo. | $10/ month |

| Quicken | Individuals who require an integrated system to manage their financial life. | No | 30 days | $2.99/month |

| ProjectionLab | Individuals planning for retirement or financial independence. | Yes | 7 days | $169/year |

Monitor, Manage and Grow with The Best Wealth Tracker App

Choosing the best wealth tracking app isn't about finding a single "best" option; it's about matching the app's strengths to the complexity of one's investments and financial goals.

While every wealth tracker offers unique features and specialisations, the ideal tool must fundamentally deliver three essentials: seamless account integration to automate data updates; reliable net worth calculation for an instant financial picture; and clear visual reporting to help users truly understand their portfolio's performance.

The best choice depends on individual needs: some may opt for Plum for everyday money management, Range for high-net-worth tax and estate planning, MyAssets for organising diverse financial and physical assets, or ProjectionLab for stress-testing complex retirement timelines.

By selecting the platform that aligns with one's goals, investors can transform a complex portfolio into a manageable roadmap.

Best Wealth Monitor App: Frequently Asked Questions

1. What is a wealth tracking app?

A digital tool that brings together all financial accounts including bank accounts, credit cards, investments, and loans, into one central dashboard, offering a comprehensive view of an individual’s overall financial situation and net worth.

2. What is the best way to track wealth?

The best way to track wealth is through a dedicated wealth tracking app that consolidates all financial data into one platform. By integrating accounts, monitoring net worth, and providing visual reports, these tools give a clear picture of an individual’s financial health.

3. What is the best app for tracking your money?

As mentioned, the best app for tracking money depends on one's financial needs and goals. Apps like Quicken and Plum offer robust budgeting and account integration, while MyAssets excels at organising diverse assets beyond just finances.

Gain Clarity and Control Over Your Wealth with MyAssets

Are you monitoring your wealth? Without visibility, managing wealth becomes a guessing game with no real direction. This makes wealth tracking and organising tools like MyAssets essential.

A specialised tool for organising, tracking, and managing assets, MyAssets delivers a complete 360-degree view of the users’ wealth by consolidating data from disparate accounts.

It pulls in everything: Bank accounts (checking and savings), investment portfolios (stocks, bonds, and mutual funds), properties (residential, rental, and commercial), and valuable assets like art and collectables.

It gets better. MyAssets doesn’t just show one’s assets; it also incorporates their liabilities, such as mortgages, loans, and credit card debts, providing an accurate calculation of one’s net worth.

Imagine having all this information presented in a visually appealing Global Dashboard. With MyAssets, managing wealth becomes easier as the platform transforms raw numbers into dynamic charts, offering a breakdown of how resources are distributed across finances, properties, collectables, and belongings.

More than that, MyAssets provides individuals with full control over account permissions, enabling them to assign who can view, edit, delete, or create asset entries. This ensures both flexibility and security when managing sensitive financial information.

Stop guessing and start knowing your assets’ true worth with MyAssets, free for 14 days.