Did you know that in some countries, foreigners can qualify for a residence permit just by investing in property?

As the saying goes, the world is your oyster: full of possibilities waiting to be explored. For investors, this is especially true when it comes to real estate, where buying property abroad can unlock opportunities such as lifestyle enhancements, investment portfolio diversification, or long-term strategic financial planning.

The real question is not 'where can I live?' but 'where can my future thrive?' From the sun-drenched coasts of Spain, a timeless favourite of British investors for its European culture, to the dynamic, forward-looking markets of the United Arab Emirates, each locale offers its own benefits.

This is an invitation to look beyond the familiar, wander through flourishing markets, and discover the best places to buy property abroad, because one property investment can open doors to various perks and privileges.

Whatever drives the decision to invest in property abroad, this article explores the best countries to buy property and what makes each destination compelling.

- Key Drivers Behind Investing in Foreign Property

- Best Places to Buy Overseas Property

- Cheap Places to Buy Abroad

- Best Country to Invest in Real Estate

- Easiest Countries to Buy Property for a Golden Visa

- Your Place, Your Choice: Determining the Best Country to Buy Property

- Best Place to Buy Property: Frequently Asked Questions

Key Drivers Behind Investing in Foreign Property

Before getting too excited about hunting for properties overseas, individuals must ask themselves, "What are my primary motivations and deal-breakers?" Doing so is crucial for narrowing down the wide range of properties abroad to buy.

From affordability to residency and return on investment advantages, this article highlights the key drivers behind selecting the best place to buy property.

Affordable Foreign Investment

In markets where the cost of living and property values are comparatively lower, investors find an attractive pathway to maximise value and broaden their property portfolio.

For instance, a UK investor could look at countries in Southern or Eastern Europe. Data from the personal finance website Finder shows that while the average price of a two-bedroom flat in the UK is about £276,000, comparable properties in countries such as Greece can be purchased at a significantly lower cost, making them a highly desirable investment.

Even better, the appeal of real estate investment abroad can be twofold: portfolio diversification and a more affordable lifestyle.

Buying in a country where property prices are modest allows investors to get more for their money. This isn't just about the lower purchase price; it also translates into a significantly reduced cost of living, from groceries and utilities to healthcare.

Indeed, Wise highlights that this enables investors to stretch their budget, potentially achieving a higher quality of life than they could back home.

Consistent Return on Investment

Real estate remains one of the most attractive investments, offering returns through the following:

Capital Appreciation

Similar to domestic markets, the value of a foreign property can appreciate over time. IP Global notes that this growth is often driven by factors such as urban development, infrastructure improvements, and rising demand from buyers and renters.

Therefore, if an investor purchases a property in a developing region or an emerging tourist destination, they can often resell at a higher price. This approach is a widely used strategy among those with a long-term investment outlook.

Rental Income

Additionally, real estate investment abroad can function as an income-generating asset. How? Renting out the property offers a consistent revenue stream that can help offset expenses such as mortgage payments, property taxes, and maintenance costs.

This strategy enables investors to have a self-sufficient asset that generates regular payments, making it a sustainable and strategic long-term investment.

See Also: Buying Your First UK Home Made Simple

Quick Residency Pathways through Golden Visa

Beyond the financial rewards of real estate investment abroad, some countries offer an added advantage by granting residency to foreign investors. This is made possible through Golden Visa programs, which provide long-term residence permits—and in some cases, a pathway to citizenship—in exchange for substantial investment.

The pertinent question to ask here is: What are the benefits of the Golden Visa? According to the global advisory firm Henley & Partners, this program is a strategic tool for high-net-worth individuals to secure their future and expand their global footprint.

Some of the advantages of the Golden Visa program include:

- Accessing a High Quality of Life and World-Class Healthcare.

- Attend First-Rate Educational Institutions.

- Establishing an Alternative Safe Haven.

- Expanding Lifestyle and Business Opportunities.

In this context, for those who wish to fast-track their residency and have the means to acquire a property abroad, a Golden Visa offers a strategic route to securing a new life, gaining greater global mobility, and accessing a wealth of new opportunities for their family.

Best Places to Buy Overseas Property

Choosing where to buy property overseas ultimately comes down to the buyer’s priorities—whether seeking a new home, a holiday escape, or a strategic investment.

Each destination presents distinct advantages, from affordability and straightforward purchase processes to promising growth potential. This guide highlights the best country to buy property in with these factors in mind.

Cheap Places to Buy Abroad

Seeking an affordable new home and a change of pace? Here is a list of the cheap places to buy abroad.

1. Greece — Budget-Friendly Mediterranean Living

Greece stands out in Europe for its cheap overseas property, delivering exceptional value. According to Wise, the average price per square meter for an apartment is around £2,308.34 in the city centre, falling to £1,929.97 in areas outside the centre.

| Country | Average cost per sqm (apartment in a city-centre) | Average cost per sqm (apartment outside city centre) |

|---|---|---|

| London | £4,645.71 | £3,719.21 |

| Greece | £2,308.34 | £1,929.97 |

Beyond the label of being the cheapest place to buy a house abroad, Greece offers:

- Benefit from a lower cost of living, particularly in Athens, when compared to other major European capitals like Paris or Rome.

- Enjoy a mild climate with long, sunny summers, perfect for a lifestyle centred around beaches and the sea.

- Immerse oneself in a rich cultural history, with nineteen UNESCO World Heritage Sites, including the iconic Parthenon.

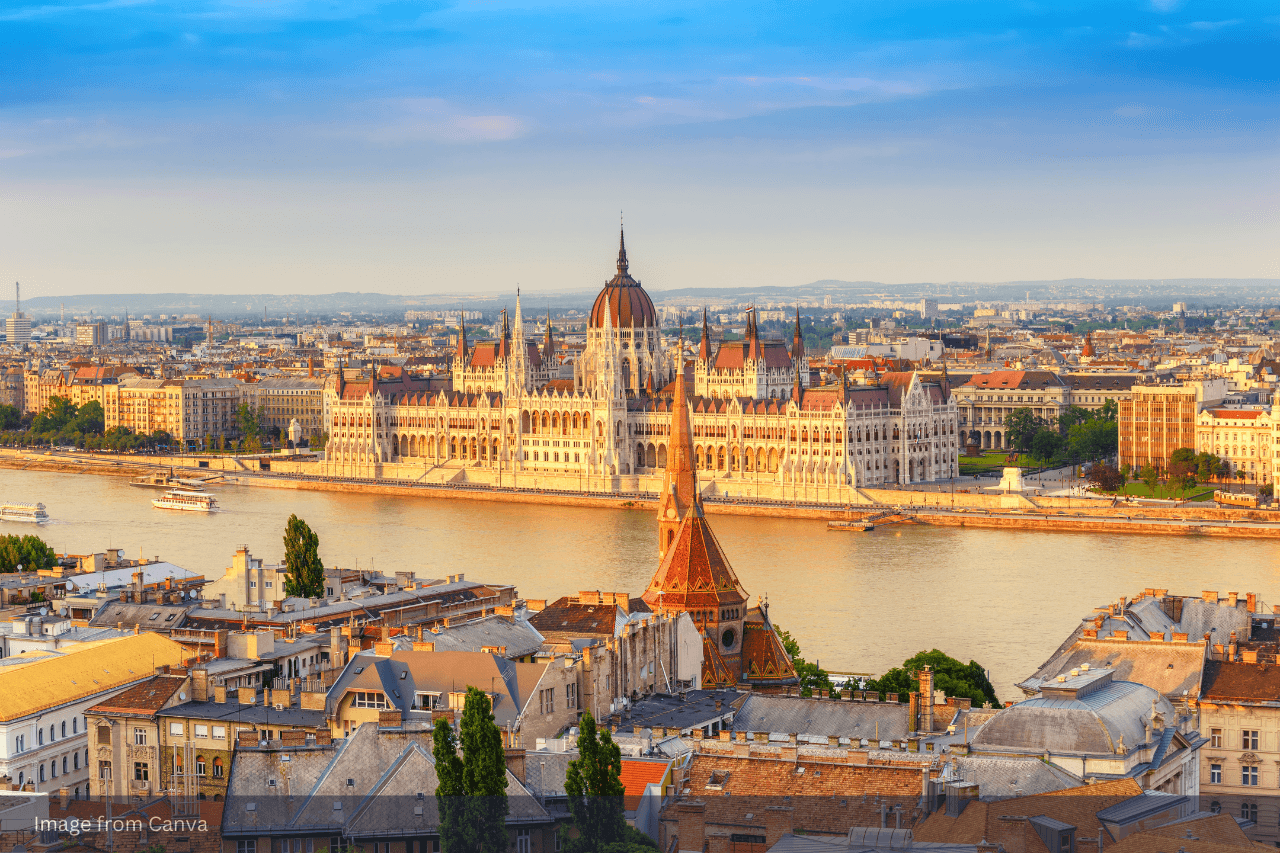

2. Hungary — Affordable Health Care

Hungary stands out as another top destination in Eastern Europe for inexpensive property. Its real estate market is highly popular with international buyers; according to Statista research, up to 40% of foreign property purchases in the country are made in Budapest alone.

To put its affordability into perspective, the average price of a newly built or luxury property is about €3,000 (£2,603.95) per square meter—far below the United Kingdom average of €9,296 (£8,068.79), according to Global Property Guide.

| Country | Average cost per sqm of a new build or luxury real estate |

|---|---|

| United Kingdom, London | €9,296 (£8,068.79) |

| Hungary, Budapest | €3,000 (£2,603.95) |

In addition to the numbers, here are some convincing reasons to invest in Hungary’s real estate market:

- Medical treatment prices are highly accessible in the UAE; for instance, dental procedures can cost as much as 60% less than they do in the United Kingdom, as per Medical Tourism.

- A wide range of property options, including mountain retreats and lakeside homes, are available for discovery.

- The Forint’s favourable rate increases the buyers’ purchasing power.

3. Thailand — Low Cost of Living

Siam Real Estate emphasises that Thailand attracts many expatriates with its much lower cost of living—about 59% cheaper on average than in the UK. This enables them to enjoy a better quality of life at a lower expense.

Moreover, property costs are a significant consideration for anyone planning a permanent move. Numbeo’s data states that buying an apartment in a city centre costs approximately £3,110 per square meter. In comparison, an apartment outside the centre costs around £1,656 per square meter, making Thailand a financially attractive and viable option for those looking for a new home abroad.

However, it is important to note that foreigners cannot own land outright. They can, however, own a condominium unit in their name if foreign ownership in the building does not exceed 49% of the total sellable floor area, says Wise. For houses and other land properties, a long-term leasehold agreement is the most common legal option.

| Country | Average price per sqm (apartment in a city centre) | Average price per sqm (apartment outside city centre) |

|---|---|---|

| United Kingdom | £4,510.02 | £3,628.81 |

| Thailand | £3,110.47 | £1,655.99 |

This raises the question: What makes Thailand the best country to buy property? Here are the main reasons investors find it so appealing:

- Strong currencies like USD, EUR, or GBP give foreign buyers favourable rates, making Thai property and living costs much cheaper.

- Thai food, petrol, and everyday goods are all very inexpensive.

- While foreign buyers are restricted to condominiums rather than land, they benefit from no land tax, reducing long-term expenses.

Ultimately, for foreign investors with affordability as a top priority, Greece, Hungary and Thailand stand out as the most accessible countries to buy property abroad due to their highly competitive real estate prices and low cost of living.

Best Country to Invest in Real Estate

Whether the goal is to secure funds, generate stable income, or maximise profit, these are among the best countries for property investment.

4. Australia — For Consistent Capital Growth

The Australian property market has a well-established history of providing consistent capital growth over the long term. According to the Direct Property Network (DPN), Australian house prices have seen an average annual growth rate of approximately 6.4% over the past 30 years.

This steady growth has led to substantial increases in property value. For example, a home purchased at the median price in 1991 was worth more than six times its original value by 2021, showcasing the market's strong performance.

It gets better, a mix of factors is driving this growth, as emphasised by ARE property advisors:

- Australia's major cities, including Sydney, Melbourne, and Brisbane, continue to draw local and international buyers with their strong economies, modern infrastructure, and high quality of life.

- The country's stable financial system and strong economic fundamentals are key factors in the reliable appreciation of its property values.

- The limited availability of land in metropolitan areas helps maintain property values, making them resilient even during economic downturns.

5. United Arab Emirates — For High Rental Yield

The United Arab Emirates (UAE), particularly Dubai and Abu Dhabi, is renowned for delivering some of the world’s highest rental yields.

Notably, recent reports from Engel & Völkers in 2024 showed significant growth, with rental values climbing by 22.6% and the number of rented units increasing by 8.7%. The market’s strong performance positions the UAE as an appealing option for real estate investors aiming for high rental yields.

What’s more is that the UAE boasts several benefits, making it the best place for investment property:

- Dubai, in particular, draws millions of tourists each year, fueling demand for both short- and long-term rental properties.

- Engel & Völkers notes that proactive and transparent government regulations, particularly from the Dubai Land Department (DLD), safeguard investors’ rights and build market confidence.

- Investors can maximise profits from rental income and property appreciation, as the UAE's tax-free environment includes no income or capital gains tax, Properstar highlights.

Read More: How to Manage Your Rental Properties with the MyAssets App

6. United States of America — For Diverse Opportunities

Esales International Property notes that the United States continues to experience steady population growth, supported by both immigration and natural increase.

This rising population drives strong demand for housing, ranging from rental units to homes for purchase—while also boosting the need for commercial spaces in high-growth areas, creating compelling opportunities for real estate investors.

Adding to this, the following factors position it as the best country for property investment:

- Investors may opt for hands-on strategies such as “buy and hold” (managing rental properties) or “fix and flip” (renovating and reselling).

- Niche opportunities, including vacation rentals (e.g., Airbnb), student housing, and mobile home parks, each offering distinct risk and return profiles.

- The U.S. is not a single market—regional economic drivers create varied growth patterns, with cities like Cleveland and Buffalo seeing strong home value gains in August 2025, while Austin and Tampa experienced declines, Zillow reports.

In essence, when considering real estate for capital growth, high rental yield, or diverse opportunities, Australia, the United Arab Emirates, and the United States stand out as some of the best investment property locations globally.

See More: What Is Property Portfolio Management?

Easiest Countries to Buy Property for a Golden Visa

Thinking about securing a Golden Visa? Investing in real estate is one of the most common paths to residency or even citizenship abroad. Discover the easiest countries to buy property as a foreigner to secure a Golden Visa.

7. Portugal — Low Physical Presence Requirement

Since its launch in October 2012, Portugal's Golden Visa program has become one of the most popular residency-by-investment options in the world. Created to attract foreign investment, the program provides a straightforward path to permanent residency and, eventually, Portuguese citizenship.

According to Arton Capital, a financial advisory firm specialising in global citizenship, over 18,000 foreign families have already used the program as a gateway to both European residency and a secure future in one of the most vibrant countries in Europe.

To add to this, the advisory firm Get Golden Visa highlights several key benefits of the program, including:

- Eligibility for Portuguese citizenship is possible in just five years—one of the fastest timelines in Europe.

- Maintaining the permit doesn’t require relocation; an average stay of just seven days per year is enough.

- Residency is available with a minimum investment of €250,000—among the lowest thresholds in Europe.

8. Vanuatu — Fast Path to Citizenship

As referenced by the consulting firm Immigrant Invest, Vanuatu's citizenship by investment program is among the fastest in the world. It offers a path to citizenship and a passport in as little as 2-4 months.

The program requires a non-refundable contribution to the country’s development fund, with a minimum of $130,000 for a single applicant.

Beyond the fast processing time, applicants can also benefit from the following:

- Applicants can hold dual citizenship, keeping their original nationality while securing Vanuatu citizenship.

- The program opens visa-free travel to more than 107 nations, including well-known hubs like the Maldives, Thailand, and Singapore.

- Vanuatu's tax system provides significant financial freedom, as it has no personal income, capital gains, or inheritance taxes.

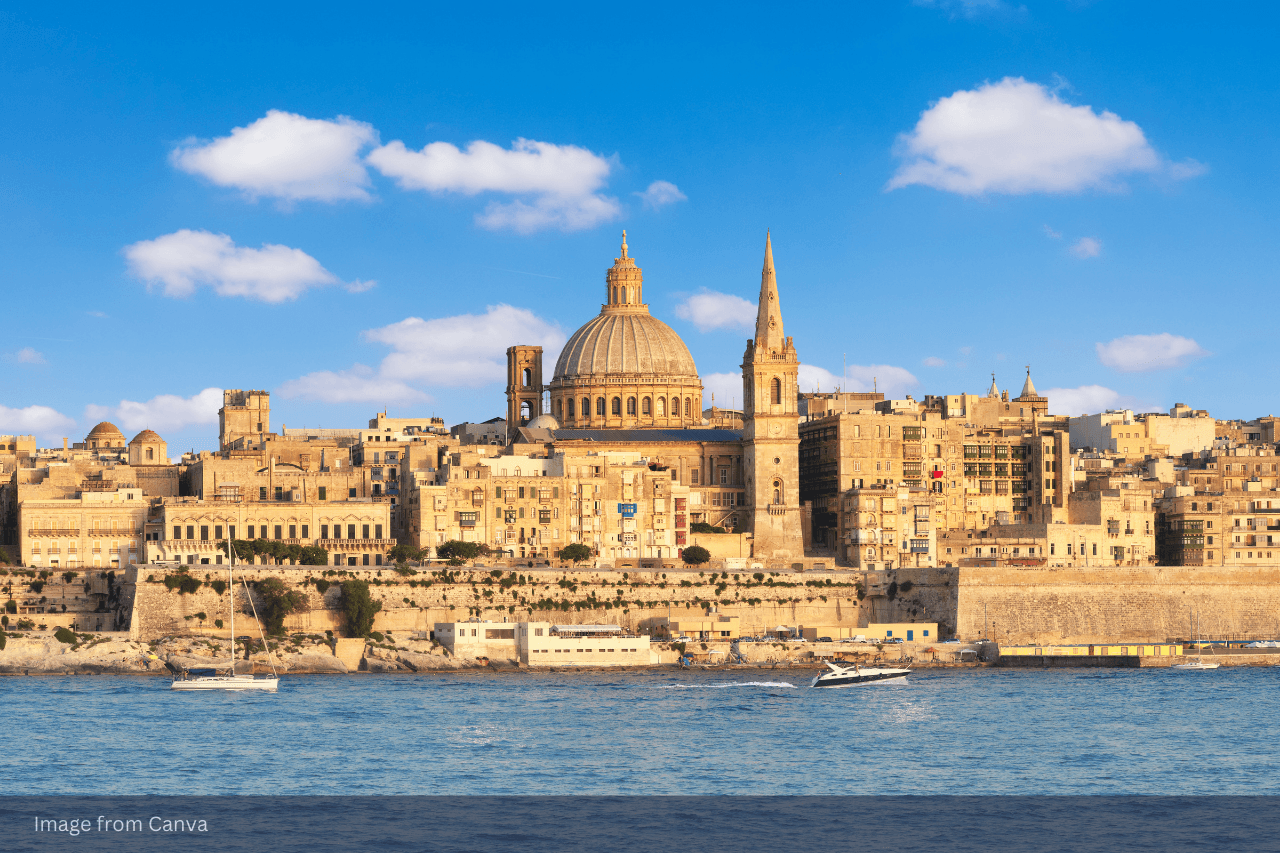

9. Malta — Permanent Residency

Officially named the Malta Permanent Residence Programme (MPRP), this residency-by-investment scheme, popularly referred to as a "golden visa," provides a pathway for non-EU citizens to live, settle, and remain indefinitely in Malta, according to Global Citizen Solutions.

Nevertheless, to qualify for such a program, applicants must either purchase a property for at least €375,000 or enter into a five-year rental agreement with a minimum annual cost of €14,000, as confirmed by Immigrant Invest.

These requirements pave the way for several advantages, such as:

- A single application for the program can include the main applicant's spouse, children, parents, and grandparents.

- The program allows for visa-free travel throughout the Schengen Area (i.e. Germany, Italy, Switzerland) for up to 90 days in any 180 days.

- Unlike a temporary residence permit, the MPRP grants lifetime residency rights, with the residence card itself being renewable every five years.

In summary, determining the "easiest" country to buy property as a foreigner to gain residency or citizenship through property investment depends entirely on one’s specific goals. Portugal is ideal for those who prefer minimal physical presence, Vanuatu offers the fastest path to citizenship, and Malta is a top choice for permanent residency.

Your Place, Your Choice: Determining the Best Country to Buy Property

The best overseas property investment is a pivotal decision, as the ideal location is determined by an investor's personal priorities. Whether one seeks affordable entry points, consistent returns, or opportunities for quick residency, these drivers will define the best place to buy property abroad.

To help find the best country to buy property, consider destinations such as Greece, Hungary, and Thailand for affordable investment opportunities. For those seeking stronger markets, countries like Australia, the United Arab Emirates, and the United States boast dynamic real estate environments with proven resilience and high rental yields.

Meanwhile, investors aiming for residency alongside property ownership may find excellent pathways in Portugal, Vanuatu, and Malta, where Golden Visa programs simplify the process.

Best Place to Buy Property: Frequently Asked Questions

1. Is buying a property abroad a good investment?

Buying property abroad can be a solid investment for diversification and potential returns, but it comes with significant risks such as currency fluctuations, complex legal systems, and distance management issues.

2. Where is the best place to buy a property abroad?

The best place to buy property abroad depends on the investor's goals, but popular choices for British buyers include Portugal, Greece, and Australia.

3. How do I manage property abroad from the UK?

Managing a property abroad from the UK can be done in two main ways. An investor can either hire a local property manager to handle all day-to-day operations or, for a more hands-on approach, leverage a property management software to efficiently oversee their property from anywhere in the world.

Every Property, Every Detail: Organised with MyAssets

Owning properties across the globe is complicated enough, and managing them adds another layer of complexity. That’s why keeping everything organised is crucial to ensure no vital details are overlooked, from ownership documents to asset location. This is where tools like MyAssets come in handy.

Primarily an asset management platform, MyAssets also serves as a property organisation tool, enabling users to organise, track, and connect all their properties—whether rental units, vacation homes, or investment estates—in one place.

MyAssets makes it easy to digitise a property portfolio, allowing users to create comprehensive entries that detail a property's historical information, such as value, repairs, and renovations, along with a wide range of other key data points. Users can log everything from the number of rooms and square footage to the insurance and mortgage details in a centralised platform.

Looking to store your documents? MyAssets’ document vault securely stores all asset-related files—from title deeds and contracts to insurance policies, and financial records—keeping them organised and easily accessible whenever needed.

It gets even better with the smart asset linking feature, which allows users to associate physical assets—such as art, family heirlooms, household items, and more—directly to their portfolio for instant access to asset location.

Say goodbye to scattered files—organise with MyAssets, free for 14 days.