In a time where data rules decision‑making, digitising your property portfolio is no longer optional – it’s essential. Transforming a traditionally analogue, paper‑driven collection of deeds, leases, maintenance records, or financial statements into a living, digital ecosystem enables scale, agility, and insight.

With digital tools, you can increase your likelihood of succeeding in real estate management. Tools enable you to monitor performance, detect underperformance, automate workflows, or make real-time, evidence-based investment adjustments.

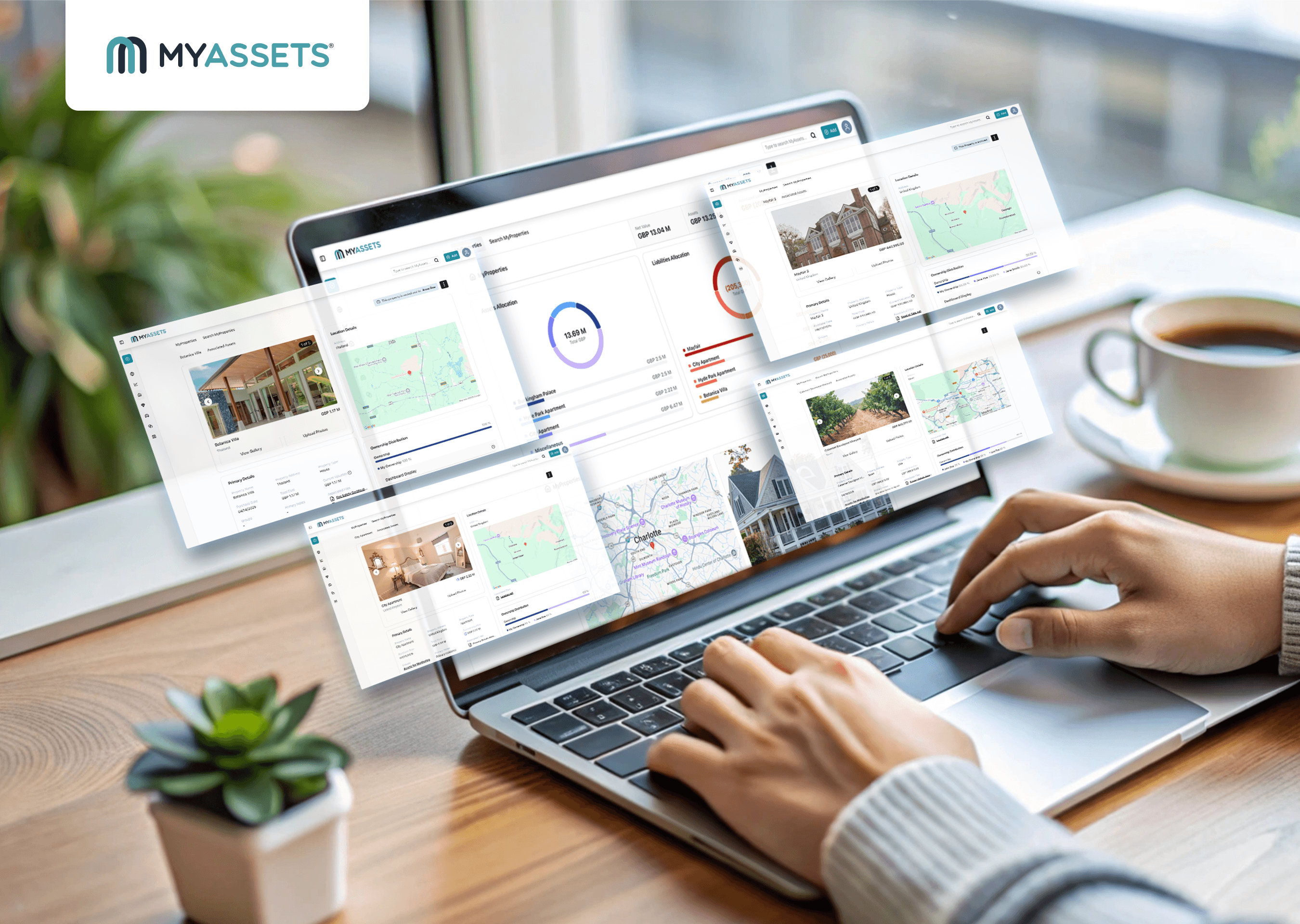

The MyAssets asset management solution exemplifies how to make this transition effective: it consolidates valuations, rental income, expenses, and mortgage details into a unified digital property dashboard, while the platform’s Document Vault securely stores and links essential contracts, title deeds, and agreements.

But digitisation is only the foundation. The real estate sector is being reshaped by newer waves of technology that add tangible value. According to PERE News, innovations like smart building systems, IoT sensors, predictive analytics, and AI-driven operational tools are becoming integral to “value-add” strategies, such as reducing energy usage, optimising tenant experience, forecasting maintenance needs, and uncovering hidden revenue levers.

These smart, data‑driven augmentations can turn a static asset into a dynamic platform that generates superior returns over time.

Successful real estate management today lies at the intersection of good fundamentals (e.g. sound location analysis, diversification, risk mitigation) and a digital backbone supplemented by smart technology.

In this article, we explain how digitising your portfolio gives you the infrastructure you need, and identify emerging technologies that help you extract more value.

- Benefits of Using a Property Digitisation Software

- Enhanced Organisation and Visibility

- Data‑Driven Decision Making

- Scalability and Delegation

- Risk Mitigation and Due Diligence

- Long‑Term Value Growth

- Why Use MyAssets for Digitising Your Property Portfolio

- 3 Steps to Digitise Your Property Using MyAssets

- Add Your Property Details in MyProperties

- Upload Property Documents to MyAssets

- Customise Property Configuration Settings in MyProperties

- Key Features of MyAssets for Digital Property Organisation

- Common Mistakes to Avoid During Property Digitisation

- Leverage MyAssets for Smarter Property Organisation

- Frequently Asked Questions: How Creating an Online Property Portfolio Improves Valuation and Maintenance

Benefits of Using a Property Digitisation Software

Creating a digital configuration of your property portfolio offers a wide array of benefits, ranging from boosting efficiency to strengthening decision‑making and long‑term growth.

Here are some of the key advantages:

1. Enhanced Organisation and Visibility

A property digitisation software consolidates all your properties’ data (e.g. valuations, addresses, mortgage details, tenancy contracts, expenses, and income) into one secure platform. Rather than poring over paper files or scattered spreadsheets, you can access everything in real time.

For example, some of MyAssets' features are the Global Dashboard and Document Vault which provide a single source of truth, helping you stay organised.

2. Data‑Driven Decision Making

When you have good structured data, you’re in a stronger position to decide which property type, location, or investment strategy fits you best. A strong market‑research foundation, property valuation and due diligence are crucial for minimising risk. Digitisation makes gathering and comparing these metrics much faster.

In MyAssets, you can generate reports to review the current data you have on uploaded assets.

3. Scalability and Delegation

If you plan to grow your portfolio, manual, disjointed systems become a bottleneck. Digitised platforms let you scale more smoothly. You can delegate tasks (e.g. maintenance scheduling, bookkeeping, stakeholder communications) while retaining visibility and control.

MyAssets offers role‑based access to Delegates, so collaborators or property managers can see what matters to them without exposing everything.

4. Risk Mitigation and Due Diligence

Digitising historical records, inspection reports, legal documents, title deeds, etc., helps you conduct due diligence much more thoroughly and efficiently. Due diligence across financial, legal, market, and physical dimensions is part of a new property investor’s journey.

MyAssets allows you to edit records for each uploaded asset, ensuring that your information is up-to-date. You’re less likely to overlook maintenance issues, regulatory changes, zoning laws, or unseen liabilities – especially when comparing properties or considering new acquisitions.

5. Long‑Term Value Growth

Finally, with a digitised portfolio, you’re better positioned to benefit from capital growth, optimise returns, and manage risks over time. Goals can be clearly set and tracked (e.g. yield targets, timeframes).

MyAssets allows you to reach your goals and track the current valuation of your assets. You can adapt strategy more nimbly when you see underperforming assets and act. This supports the wealth‑building advantage that property investment promises.

Why Use MyAssets for Digitising Your Property Portfolio

In today’s fast‑paced real estate market, keeping track of multiple properties through spreadsheets or paper records is increasingly inefficient and error‑prone.

MyAssets offers a modern, digital solution to organise your property portfolio in one centralised platform. It enables you to store comprehensive property data (e.g. location, acquisition and ownership details) alongside financial and physical assets.

One key advantage is improved data accuracy. Rather than relying on manual entry across different tools, MyAssets enables you to create comprehensive records in one central platform, reducing errors and duplication and enabling real‑time updates.

Another strength is generating downloadable reports, which you can use to generate insights, see trends, evaluate underperforming properties, and make data‑driven investment decisions.

Because it’s accessible from both web and mobile devices, you can monitor your portfolio anytime, anywhere. With security safeguards like protected APIs, your sensitive property information remains safe.

Digitising your property portfolio with MyAssets means less administrative burden, greater visibility, and stronger decision‑making power—all from a single, unified platform.

Read more: The Best Places To Buy Property Abroad for Investors

3 Steps to Digitise Your Property Using MyAssets

Use MyAssets to easily create digital records of your property portfolio on the platform.

1. Add Your Property Details in MyProperties

Include each of your real estate assets under MyProperties, where you can add Primary and Additional Property Details such as:

- Property Type

- Property Location

- Current Valuation

- Acquisition Details

- Configuration Details

- Ownership Details

This enables you to have comprehensive profiles for each property, ensuring that relevant information is accessible and stored securely on the platform.

2. Upload Property Documents to MyAssets

You have the option to add files and images under Attachments when you add a property in MyAssets. You can also choose to upload attachments through Document Vault at a later time.

The Document Vault allows multiple files and image uploads (e.g. contacts, master deeds, etc.). you could also link these media files to the relevant property records you created.

Each document is stored in its relevant section or folder under a particular property (asset), making information retrieval straightforward.

All uploads are protected by bank‑grade encryption and encrypted storage, ensuring that only you and authorised delegates can see them.

3. Customise Property Configuration Settings in MyProperties

Customising property configuration details in MyProperties empowers users to tailor their real estate records to reflect nuances that standard templates can’t capture. You can include information such as the measurement of internal and external areas and the plot of land, as well as the number of rooms in the property.

By adjusting these highly customisable fields, you ensure each property’s profile aligns precisely with its real‑world circumstances.

Searching, filtering, and reporting become intuitive once you have properly configured your digital management system. Delegates can be granted access with confidence, since they will see only the settings relevant to their role, reducing errors and protecting data integrity.

This custom setup ultimately leads to sharper insights, better decision-making, and a property portfolio that’s organised not just broadly but exactly how you need it to be.

Key Features of MyAssets for Digital Property Organisation

In managing a property portfolio digitally, having the right features makes all the difference. MyAssets includes several key asset management features that can help you efficiently organise, monitor, and optimise your holdings.

- Smart Asset Linking allows you to link properties to assets across different categories. This gives you a complete look into the connections of your assets with each other.

- Comprehensive Auditing Features ensure accountability and compliance. MyAssets offers document archiving (e.g. contracts, photos, titles) and flexible user roles and permissions so that you can control who sees or modifies what.

- Flexible Interface Features let you adapt the platform to your needs. You can customise data fields relevant to properties (e.g. valuation, condition, location) and group assets according to your preferences.

- Insightful analytics and reporting give you an overview of your portfolio. MyAssets enables dashboards, exportable reports, and visual summaries that help you see trends, measure net worth, detect underperformers, and make informed decisions.

- Security and document management ensure your files are secure. MyAssets is equipped with bank‑grade encryption and controlled delegate access to ensure sensitive property data (e.g. deeds, leases, insurance papers) is safe yet accessible.

Together, these features position MyAssets as a robust platform if you want order, insight, and control over your real estate investment portfolio.

Common Mistakes to Avoid During Property Digitisation

Digitising your property portfolio promises streamlined operations, better data visibility, and reduced manual workload. But many individuals and organisations stumble, undermining their efforts.

Below are typical mistakes, and how an effective property management software helps avoid them.

- Fragmented or inconsistent data storage: When different systems manage leases, maintenance, accounting and tenant communications separately, data becomes duplicated, lost, or hard to reconcile. MyAssets emphasises that good property management platforms provide document storage, financial accounting, lease management, and reporting all in one place, ensuring centralisation.

- Reliance on manual processes: Handwritten logs, spreadsheets, and email threads are slow, error-prone, and difficult to audit. Using software allows automation of routine tasks (e.g. rent collection reminders, appointment scheduling, maintenance request tracking), which reduces human error and frees up time.

- Poor change management and staff training: Even a powerful platform is useless if users cannot navigate it properly or resist the transition. It’s important to choose a property organisation tool that highlights usability.

- Neglecting security, permissions, and data updates: Outdated information, lost audit trails, or compromised documents can expose you or your property portfolio to risk. Software solutions such as MyAssets include features, such as the Document Vault and access control for Delegates, helping control who can view, edit, or delete data.

To avoid common property management pitfalls, adopt a unified, automated, secure platform and maintain consistent, clean data. MyAssets’ reviewed features illustrate how that combination can transform time‑draining property tasks into efficient, manageable workflows.

Learn more: How to Manage Your Rental Properties with the MyAssets App

Leverage MyAssets for Smarter Property Organisation

Handling multiple properties can become overwhelming without a unifying system. MyAssets offers a solution that help simplify life admin tasks by putting all your assets, including properties, belongings, finance accounts and more, into one central, secure platform.

With MyAssets, you can organise your entire property portfolio under MyProperties, where you log details like acquisition date, location, market value, and associated documents. Beyond that, the Document Vault feature lets you store contracts, receipts, images, and other critical files securely – so when you need a document, you know exactly where to find it.

The Groups functionality lets you categorise your properties according to your preferences, while the Global Dashboard gives you a snapshot of your total net worth across all asset types. This helps you see how your properties fit in with your finances and other belongings.

By bringing all this together, MyAssets reduces duplicated effort, cuts down on lost documents or missed deadlines, and lowers the mental burden of managing many moving pieces. The result is a smarter property organisation: you stay better informed, more in control, and less stressed.

Frequently Asked Questions: How Creating an Online Property Portfolio Improves Valuation and Maintenance

1. How does digitalising my property portfolio help increase property value?

Digitalising your property portfolio increases property value by making it easier to manage, track performance, and present organised data to buyers or investors, enhancing transparency and efficiency.

2. How does digital maintenance tracking improve upkeep?

Digital maintenance tracking ensures timely repairs, reduces costly issues, and helps preserve the property's condition, boosting long-term value and tenant satisfaction, if applicable.

3. What information can I store with MyAssets when I digitise my portfolio?

With MyAssets, you can store property details, purchase records, legal documents, maintenance logs, valuations, photos, and insurance policies – all in one secure, centralised place.

MyAssets: The Next Step to Smart Property Organisation

Using MyAssets to organise and digitise your property portfolio offers a smart, secure, and streamlined solution for modern property management. It centralises all property-related documents, valuations, and key data in one easy-to-access digital platform, eliminating the hassle of paper trails and manual tracking.

Whether you're managing a single property or a diverse portfolio, MyAssets empowers you to stay in control, increase efficiency, and protect your investments. In a digital age, it’s the smarter way to manage your assets confidently and effectively.

Start your 14-day free trial and digitise your property portfolio with MyAssets.