Are you thinking about buying property for investment? The world of property investment can feel overwhelming, filled with unfamiliar terms and intricate processes. Though it comes with its challenges, property remains a trusted and rewarding way to build lasting wealth — one that many people still actively pursue.

In fact, leading real estate consultancy Knight Frank forecasts a 3.5% rise in UK house prices by the end of 2025. Even more compelling, cumulative growth over the next five years is projected to reach 22.8%, up from a previous forecast of 19.3%.

These figures underscore the appeal of property as a stable and rewarding investment, making it more captivating to learn how to invest in property.

The good news? This quick guide to property investment for beginners breaks everything down. From understanding the fundamentals to navigating the buying process, this article walks through key concepts, considerations, and steps to help first-time investors get started with confidence and achieve financial success.

- Property Investment 101: Understanding the Basics

- Top Things to Consider Before Investing in Property

- How to Invest in Property as a Beginner

- Set Investment Goals

- Perform Market Research

- Select a Type of Property Investment

- Secure Financing

- Conduct Property Due Diligence

- Popular UK Real Estate Strategies Explained

- Property Investment for Beginners: Frequently Asked Questions

Property Investment 101: Understanding the Basics

Property investment is a long-term strategy for building wealth and increasing net worth. But how can you invest in real estate without understanding the fundamentals?

Covering core concepts and benefits this article offers foundational knowledge for real estate beginners.

What is Property Investment?

Growth Capital Ventures defines property investments as the acquisition, ownership, management, and eventual sale of real estate assets. The core objective of these activities is to generate financial returns, which can manifest as income (e.g., rental revenue), capital growth (appreciation in property value over time), or a combination of both.

Emphasising this pursuit of financial gain, property investments are those physical assets not intended for personal residence. This means they are acquired to generate profit through rent, resale, or both, rather than for an individual's primary living space, says Investopedia.

Why Property Investment is a Smart Move for Beginners

While defining property investment is essential, understanding its benefits highlights why it remains a core component of wealth management strategies.

Steady Cash Flow

Cash flow is the profit left after covering mortgage payments and operating costs. Because of this, Investopedia notes that one of the advantages of property investment is generating steady cash flow, which often grows over time as the mortgage is paid down and equity builds.

Strategic Portfolio Diversification

Real estate also offers strong diversification benefits. Since it often moves differently from stocks and other assets, adding property to a portfolio can help reduce risk and make overall returns more stable.

Promising Real Estate Growth

Michael Poole, an estate agency, reports a significant 11.9% increase in rental prices across the North East. Complementing this, Fleet Mortgages highlights that the North East of the UK boasts an average rental yield of 8.6%, solidifying its position as a top performer in the UK rental market.

This substantial growth indicates a compelling opportunity for property investors to expand their portfolios in the region, as it currently offers some of the highest rental growth rates and strong yields in the UK.

Top Things to Consider Before Investing in Property

1. Property Location

Property location remains the cornerstone of real estate success. For residential properties, nearby amenities, scenic views and neighbourhood status boost value, while for commercial investments, access to markets, warehouses, transport hubs, and freeways is critical, Investopedia highlights.

2. Property Valuation

Estate Agent Roberts Property emphasises that property valuation enables investors to determine a property's fair market value. It also gauges potential returns and makes informed decisions on buying, selling, and managing assets.

According to the accounting software REI Hub, several factors influence property valuation, such as:

- Demand: Is there demand for the property? Can buyers afford it?

- Utility: Does it meet a future owner's needs?

- Scarcity: Are there many like it for sale?

- Transferability: How simple is it to transfer ownership?

3. Financial Implications

Many investors fund their property purchases through a combination of personal savings and a mortgage. Property investment company Yield Investing states that if a mortgage is part of the plan, they must compare rates and terms from various lenders to secure the most favourable option.

Beyond the initial purchase price, several other costs must be factored into one’s budget:

- Daily property portfolio management tasks

- Estate agency fees

- Insurance

- Land registry fees

- Mortgage costs

- Solicitor fees

- Survey costs

- Taxes

4. Credit Score

An individual's credit score influences their ability to qualify for a mortgage, as well as the terms and conditions a lender is willing to offer. Generally, a higher score leads to better loan conditions, potentially saving a significant amount over the life of the mortgage.

Read More: Net Worth vs Credit Score: What Tells the Real Story?

5. Tax Considerations

Property investors in the UK must be aware of several tax implications and additional reporting requirements to avoid penalties.

Here are some obligations to take note of:

- Capital Gains Tax (property sales)

- Income Tax (rental profits)

- Stamp Duty Land Tax (property purchases)

How to Invest in Property as a Beginner

For beginners, learning how to invest in property can feel daunting. Luckily, this quick guide to property investment demystifies the process, breaking down the essential steps to help real estate beginners learn how to get started in real estate investing.

1. Set Investment Goals

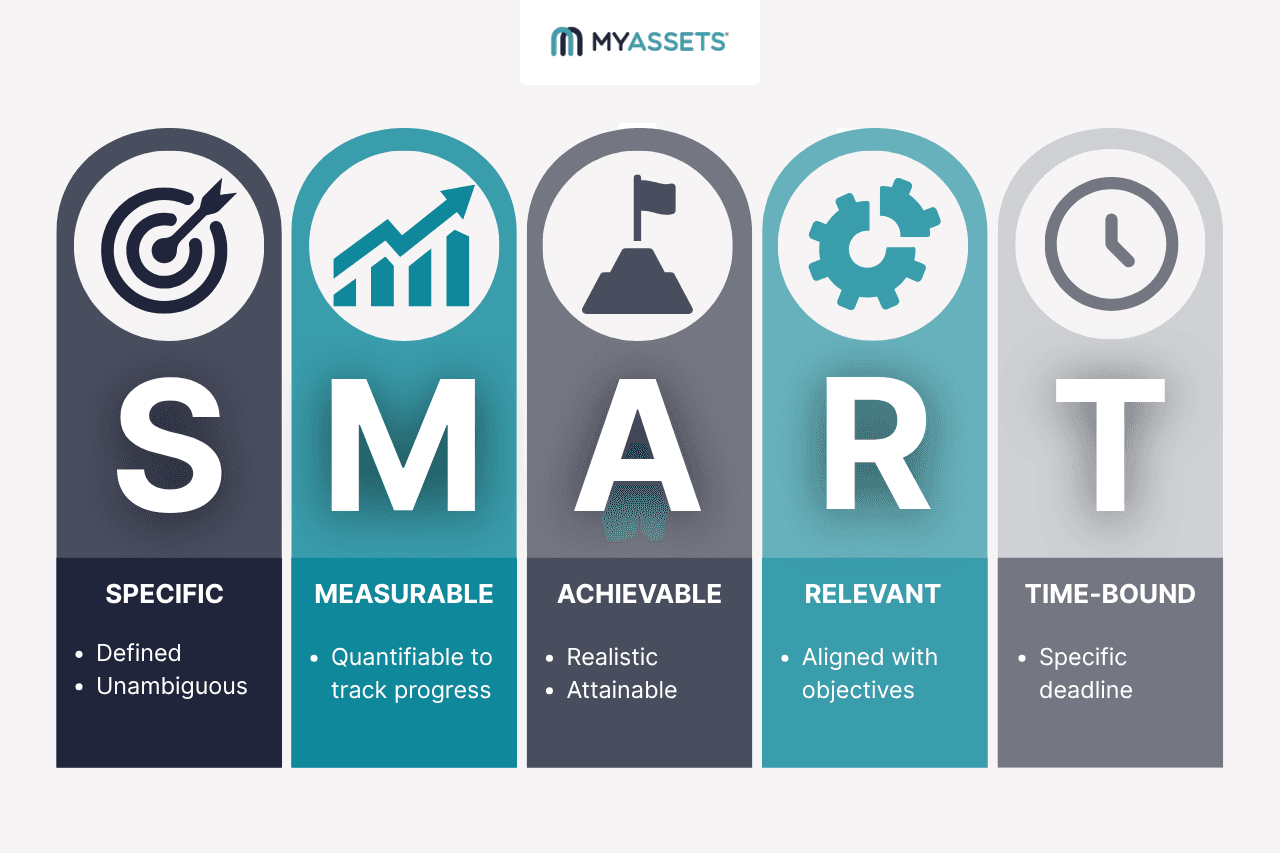

Setting goals acts as a roadmap when buying property for investment. As Property Investments UK suggests, investors can implement the SMART method to ensure their goals are:

- Specific: Defined and unambiguous (i.e. achieve a 7% rental yield).

- Measurable: Quantifiable to track progress (i.e. £1,500 net monthly income per property after all expenses).

- Achievable: Realistic and attainable given current resources and market conditions. (i.e. buy a £250,000 two-bedroom flat in Leeds for short-term rentals via Airbnb, with a projected monthly income of £1,100).

- Relevant: Aligned with financial objectives and personal circumstances (i.e. Acquire five single-let properties in commuter towns around London by 2027 to generate £3,500 monthly income and replace current salary).

- Time-bound: Set with a specific deadline to create urgency and accountability (i.e. purchase commercial property within 12 months).

2. Perform Market Research

Market research involves collecting, examining, and evaluating data to understand the conditions and trends of a specific real estate market. As highlighted by the commercial real estate broker The Cauble Group, it consists:

- Demographic Trends: The shift in population size, age distribution, income levels, household compositions, and other factors influencing current and future real estate demand.

- Economic Factors: The broader economic indicators that impact the real estate market's health and direction (i.e. interest rates, inflation, GDP growth, employment rates, and consumer confidence).

- Property Information: Data containing the physical characteristics, historical performance, and past transactions of properties within a given market.

- Regulatory Environment: Local zoning laws, building codes, and other governmental regulations affecting real estate development, property use, and investment viability.

- Supply and Demand Dynamics: The comparison between how many homes are on the market and how many people are searching for one.

Through market research, investors are able to identify profitable locations, understand supply and demand, and analyse other factors impacting property value and potential returns.

3. Select a Type of Property Investment

For beginner property investors, selecting a type of property investment that aligns with their objectives and risk tolerance is essential. This is a crucial step as it ensures their chosen approach is tailored to their financial goals.

In the UK, some of the most common types of property investment include:

- Buy-to-let: Purchasing a residential property with the intent of renting it out, generating consistent rental income and potential capital appreciation.

- Commercial Properties: Acquiring non-residential buildings, such as offices, retail units, or industrial warehouses –all of which are leased to businesses to generate rental income.

- Holiday Home/Let: Buying a property to rent out for short periods, typically to tourists or holidaymakers, aiming for higher nightly rates than long-term rentals, often managed via platforms like Airbnb.

- Houses in Multiple Occupation: Renting out individual rooms within a single property to multiple, unrelated tenants, often providing higher rental yields than traditional single-let properties, but subject to stricter regulations.

- Off-Plan: Purchasing a property from a developer before construction is completed or even started, to benefit from capital appreciation by the time it is finished.

- Property Abroad: Investing in real estate located outside of one's home country, often for diversification, higher potential returns, or personal use, but subject to foreign laws, taxes, and market conditions.

- Property Development: Acquiring land or existing structures and undertaking construction, renovation, or conversion projects to create new or improved properties, to sell them for profit.

- Real Estate Investment Trusts (REITs): Investing in companies that manage, develop, or finance income-generating properties. Through publicly traded trusts, investors can participate in real estate gains without directly holding or overseeing physical assets.

4. Secure Financing

Unbiased, a UK-based website, defines property investment financing as securing funds for property acquisitions via loans, mortgages, partnerships, or equity.

The fundamental principle is strategically leveraging borrowed or invested capital to purchase properties, to achieve profits greater than the expense of the financing.

Property Investment Financing Options

The vital question to answer here is: Can you take out a loan to finance a property investment? Financial services company Holborn Property Investments suggests the following financing options that investors should consider:

- Bank Loan: Traditional financing option characterised by lower interest rates and longer repayment periods, but typically with stricter eligibility criteria like a good credit score and a sizable deposit.

- Hard Money Loan: Short-term loans backed by the property's value itself, rather than the borrower's credit score. While they come with higher interest rates and quick repayment schedules, they are ideal for situations requiring fast capital, like property flipping or renovations.

- Private Loan: A flexible alternative to traditional banks, especially when negotiating terms, such as interest rates, repayment schedules, and collateral requirements. While interest rates can be higher, their streamlined approval process is a significant advantage, particularly when time is critical.

While investors have a variety of financing options available, Blue Square Capital emphasises that the most suitable choice depends on an individual's financial health, investment strategy, and the specific property they intend to acquire.

5. Conduct Property Due Diligence

Property due diligence refers to an in-depth evaluation conducted before purchasing an investment property. It aims to assess the property’s true investment potential while uncovering any underlying risks or issues that could affect the decision to proceed.

This naturally leads to the question: What are the essential checks involved in conducting comprehensive property due diligence? Below are the primary steps included:

- Financial Due Diligence (property value, rental income and expenses, financial statements, mortgage and loan options).

- Legal Due Diligence (property title, contracts and agreements, zoning and regulatory compliance, environmental issues).

- Market Due Diligence (market conditions, property’s potential, future development plans).

- Physical Due Diligence (property inspection, environmental assessment, building permits and approvals).

By administering these diligence processes, investors minimise potential risk and maximise their chances of successful property management.

Read More: How To Be Successful In Property Portfolio Management

Popular UK Real Estate Strategies Explained

Property investment for beginners can seem complex at first, but with the right steps, it becomes a clear and achievable path to building wealth.

Start by setting defined investment goals, researching the UK market, and selecting a property strategy that suits one's objectives—whether it’s buy-to-let, commercial properties, or property development.

Securing financing and conducting proper due diligence are also key to minimising risks. This means exploring loan options, understanding associated costs, and ensuring the property aligns with local market trends and legal requirements.

With a strong foundation and informed choices, beginners can confidently enter the property market and start growing their investment portfolio.

Property Investment for Beginners: Frequently Asked Questions

1. Is it worth investing in property for beginners?

For beginners, property investment can be a valuable long-term approach, offering opportunities for passive income, capital growth, and portfolio diversification, but it also requires careful planning and risk awareness.

2. What type of investment property is best for beginners?

A buy-to-let investment can be a smart starting point for newcomers to the property market. It enables them to generate rental income, which can help support long-term financial goals such as saving toward a future home purchase.

However, it requires an initial deposit and a sufficient income to cover mortgage payments during potential periods of vacancy, as per research.

3. What is the 2% rule?

The “2% rule” is a general benchmark in real estate investing that suggests a rental property should generate monthly rent equal to at least 2% of its purchase price.

This rule offers a quick way for investors to evaluate whether a property is likely to produce positive cash flow, covering its costs while still yielding a profit.

MyAssets: Your All-in-One Solution for Property Portfolio Organisation

Investing in property is one thing, but organising and managing them is another. That’s where tools like MyAssets become invaluable. By offering a centralised platform, MyAssets empowers investors to stay organised and access critical details anytime, all in one place.

MyAssets is an asset management platform designed to simplify property organisation by consolidating vital information –from property values and addresses to documents and key contacts.

Taking property organisation a step further, MyAssets allows users to link any asset—from prized collectables to everyday items—directly to the property they are stored in, creating a more detailed and organised portfolio.

Need to manage properties with other stakeholders? MyAssets supports flexible delegation, allowing owners to assign roles and set clear access levels for each stakeholder—ensuring control over what they can see and do.

Experience full visibility and control over your properties—free for 14 days with MyAssets.