The strain of managing properties lies not just in the volume of work but in the chaos of unorganised documents and the constant risk of missing a crucial task. This is where property portfolio management steps in, easing potential stress into a well-organised workflow.

In fact, its growing relevance is evident: in 2023, the number of property management businesses in the UK rose to 22,751. According to leading property management firm Scanlans, portfolio management services saw a 3.3% increase from 2022, signalling a rising trend towards outsourcing property management tasks.

But the real question is: What exactly is property portfolio management? This article breaks it down by exploring what property portfolio management involves, the benefits it offers, and the tools that can help simplify the process.

So, whether you are a landlord or property investor, understanding these fundamentals is the first step to managing property effectively.

- What is Property Portfolio Management?

- Who Uses Property Portfolio Management

- Benefits of Portfolio Management

- Tools that Help Manage Your Property Portfolio

- From Insight to Action: Mastering Property Portfolio Management

- Portfolio Management: Frequently Asked Questions

What is Property Portfolio Management?

Business Case Studies defines property portfolio management as a multifaceted discipline that involves overseeing and optimising a collection of real estate investments. Investors, landlords, property managers, and real estate firms rely on this process to drive returns and maintain asset value.

Key Components of Property Portfolio Management

Given its wide-ranging functions, property portfolio management covers various components, including:

- Acquisition and Disposal Decisions: Choosing when and what properties to buy, sell, or hold to optimise the portfolio.

- Asset Allocation: Assessing the ideal combination of property types (residential, commercial, industrial) and locations to manage risk and maximise returns.

- Legal and Regulatory Compliance: Ensuring all properties and operations adhere to relevant laws, regulations, and codes.

- Maintenance and Operational Oversight: Managing all day-to-day upkeep, repairs, and functionality to keep properties in optimal condition.

- Performance Monitoring and Reporting: Tracking financial and operational metrics to assess portfolio health and make sound decisions.

- Property Valuation: Determining the monetary worth of each property and evaluating its investment potential by understanding market trends and influencing factors.

- Rental Income Management: Optimising rent collection, lease agreements, and occupancy to maximise revenue from properties.

- Strategic Planning and Goal-Setting: Defining the overall vision, financial targets, and long-term roadmap for the entire real estate portfolio.

Essentially, property portfolio management focuses on enhancing the value and returns of property investments through planning, management, and informed decision-making –all of which benefit the entire portfolio.

Read More: How To Be Successful In Property Portfolio Management

Who Uses Property Portfolio Management

Portfolio management is a strategic practice used by various entities, each with unique goals and resources. To understand this further, here are the different types of investors who engage in property portfolio management:

Individual Investors

Individual investors are everyday people who invest in real estate for their financial well-being. These are typically landlords and real estate investors managing smaller sums of money.

- Landlords: Individuals owning multiple rental properties who use portfolio management to streamline operations, manage finances, and maximise returns.

- Real Estate Investors: Those who hold diverse property investments, including residential, commercial, and vacation rentals. Utilising commercial property portfolio management helps them track performance, manage risks, and identify growth opportunities across their varied portfolios.

Institutional Investors

Alternatively, institutional investors are organisations responsible for managing and investing significant sums of capital on behalf of clients, members, or beneficiaries.

This group includes Real Estate Investment Trusts (REITs), Pension Funds, and Insurance Companies –entities that typically possess greater resources, broader market access, and deeper insights than individual investors.

- Real Estate Investment Trusts: They collect investments from numerous investors to acquire and oversee income-generating properties, necessitating portfolio management practices.

- Pension Funds and Insurance Companies: These organisations allocate significant capital to real estate and depend on portfolio managers to oversee their property assets.

Despite their differences, both types of investors share the same core purpose: to enhance their returns by managing their portfolios to suit their specific circumstances and financial objectives.

Benefits of Portfolio Management

From the moment real estate is acquired to its eventual sale, portfolio management serves as a strategic practice that goes beyond routine property upkeep. Here are some notable benefits of this approach.

Increase Property Value

According to estate agent Yates Hellier, a core aspect of property portfolio management involves conducting routine maintenance and timely repairs to preserve and potentially enhance a property's condition and long-term value.

Supporting this view, an e-commerce platform, OpenCart, explains how upgrades such as modern appliances or fresh landscaping contribute to attracting high-quality tenants and maintaining a property's competitive edge in the market.

Essentially, by preserving and enhancing a property's appeal and functionality, property portfolio management contributes to its increased value.

See Also: 5 Powerful Strategies to Increase Your Net Worth

Mitigate Risks

Like any investment, properties come with their fair share of risks, Paragon Property highlights. Market fluctuations, geographic-specific challenges, and changing interest rates can all significantly impact return on investment and overall financial stability.

In this sense, portfolio management becomes invaluable. It conducts the planning, management, and decision-making necessary to navigate these risks and safeguard one’s investments.

Improve Decision Making

As a data-driven practice, portfolio management involves continuous decision-making. Whether it is identifying opportunities for expansion, renovation, and strategic sales or selecting which properties to acquire, hold, or sell, this approach provides individuals with the clarity and insights needed to make profitable choices.

Tools that Help Manage Your Property Portfolio

Leveraging software solutions enhances portfolio management by automating routine tasks and minimising administrative workload. Here are some property portfolio management tools that can simplify portfolio oversight.

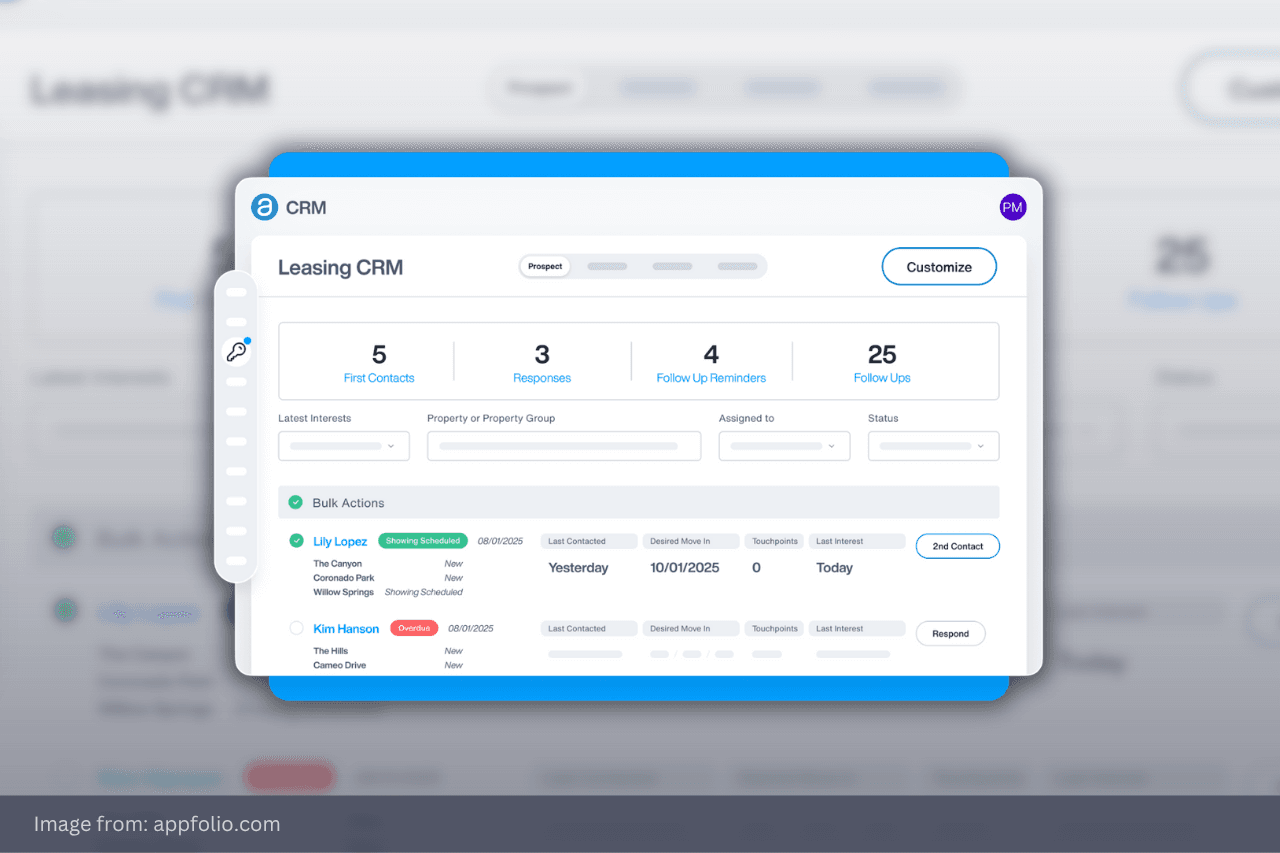

1. Appfolio

Balanced Asset Solutions highlights AppFolio as a cloud-based property management platform that simplifies operations across residential and commercial properties.

Some notable features of AppFolio include the ability to market properties, screen tenants, automate rent collection, manage maintenance, and generate detailed reports.

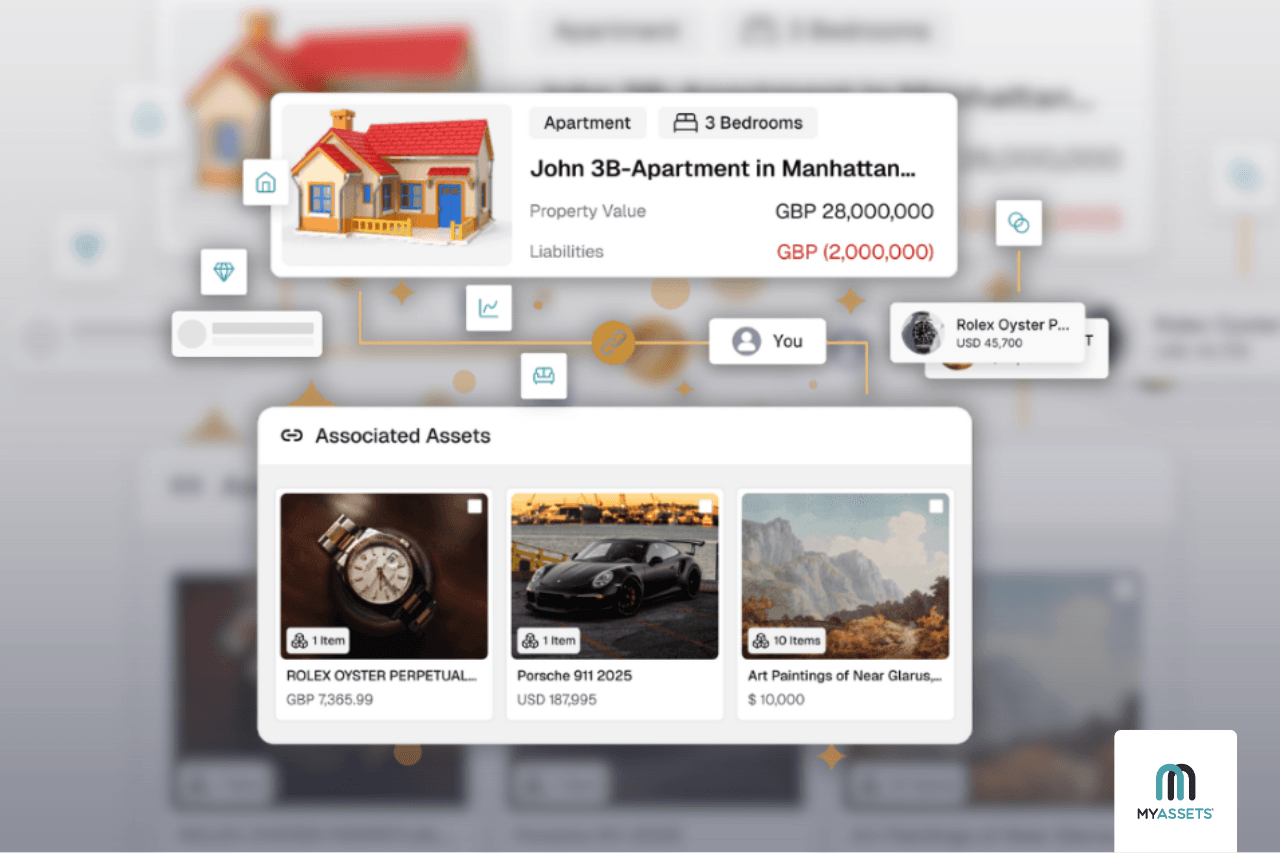

2. MyAssets

Primarily an asset management platform, MyAssets offers a property organisation tool that sorts and manages vital information associated with the user’s properties. From property value and addresses to documents and contacts, MyAssets centralises everything they need for seamless property management.

Even better, MyAssets takes pride in its smart asset linking feature, which allows users to connect any asset—be it a precious family heirloom, a vehicle, or a household item—to the specific property it belongs to.

To support better organisation, MyAssets provides a group feature that lets users organise their properties based on custom criteria, such as city, purchase date, or any classification that fits their preferences.

Managing properties with multiple stakeholders? MyAssets includes delegation capabilities. This allows property owners to assign delegates and customise asset control, tailoring permissions to specify what each delegate can view, edit, create, and delete within their account.

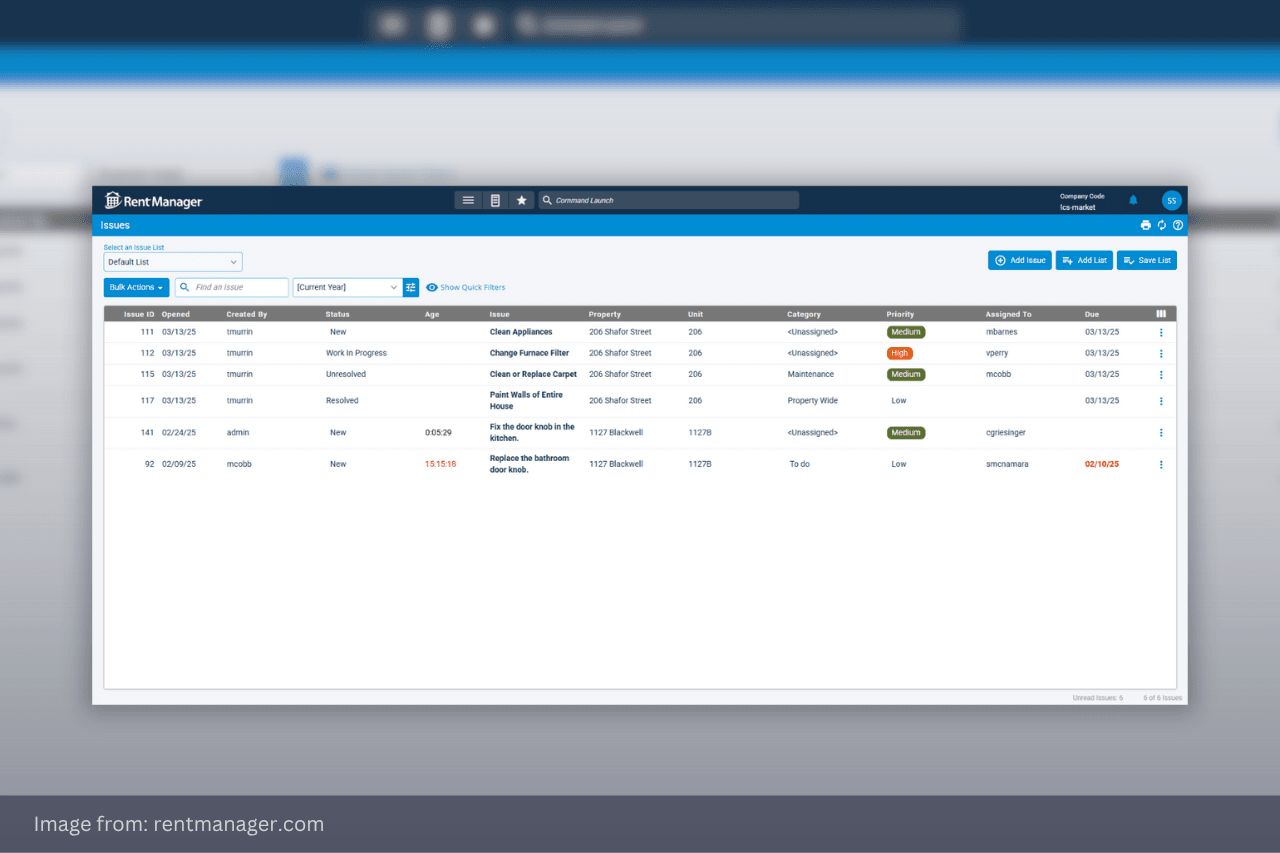

3. Rent Manager

Rent Manager is another property management software designed to assist with managing residential, commercial, association, manufactured housing, self-storage, and short-term stay portfolios of any size.

Software Advice highlights that Rent Manager boasts fully customisable features, such as a double-entry accounting system, maintenance management and scheduling, community engagement tools, marketing integrations, and a variety of reports.

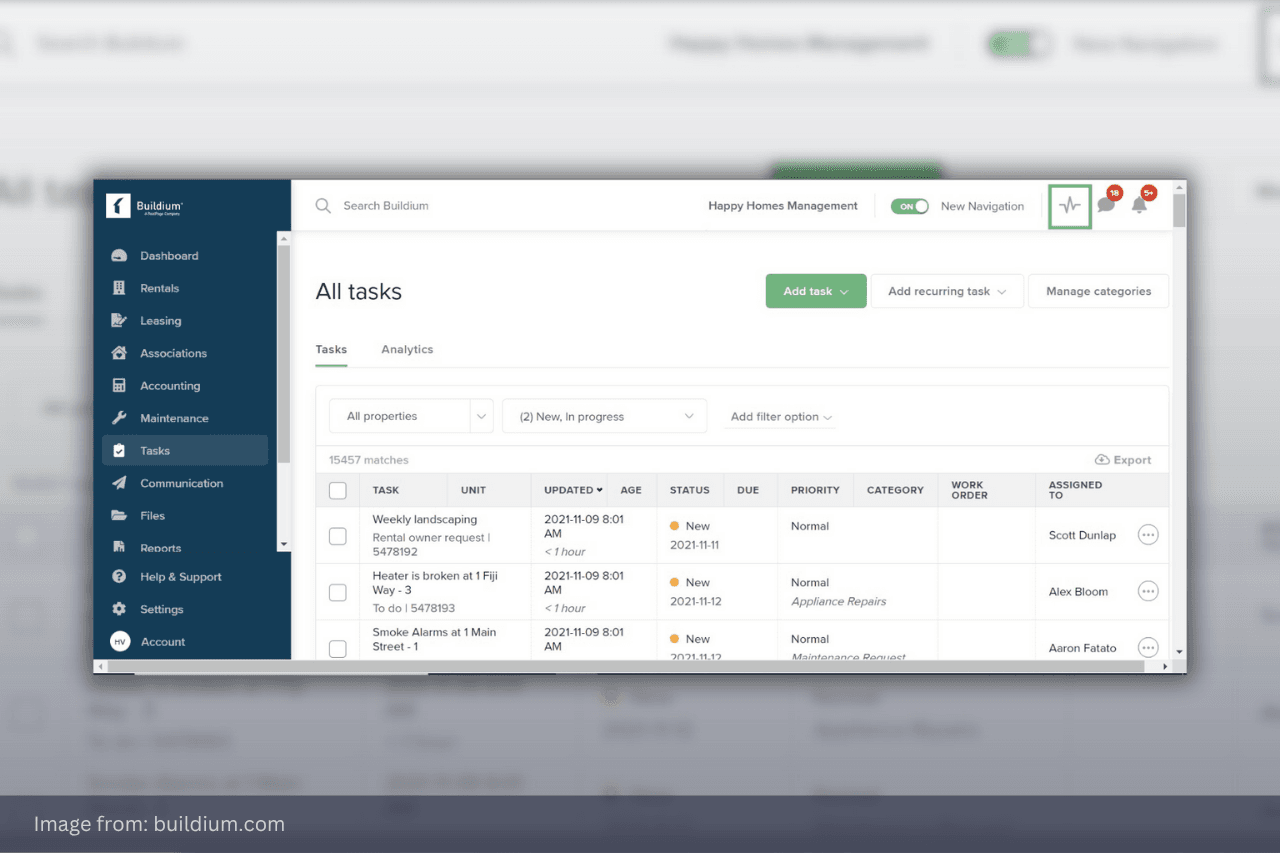

4. Buildium

Buildium is a widely used property management platform that offers a wealth of tools for property management, accounting, business operations, and leasing.

Buildium’s most recognised features include online leasing and payments, maintenance management with online request submissions, and dedicated portals for residents and owners.

Also Read: Powerful Apps to Take Control of Personal Asset Management

From Insight to Action: Mastering Property Portfolio Management

Property portfolio management extends beyond simple ownership—it involves strategically overseeing multiple assets to build long-term value and minimise risk.

Whether managed by individual investors or institutional investors, managing properties enables smarter decisions on acquisitions, disposals, asset allocation, and maintenance.

With the right property portfolio management tools and oversight, portfolio management transforms real estate from a static investment into a dynamic, performance-driven asset class.

Portfolio Management: Frequently Asked Questions

1. What is the meaning of property portfolio management?

Property portfolio management is the process of strategically overseeing multiple real estate assets to maximise returns and align with investment goals.

It involves making informed decisions on acquisitions and disposals, asset allocation, maintenance oversight, and long-term planning. These examples of property portfolio management help ensure performance, minimise risk, and support sustainable growth.

2. What is portfolio management in real estate?

Portfolio management in real estate is the strategic coordination of multiple property assets to optimise returns, manage risks, and align with overall financial objectives.

It applies property investment principles—such as diversification, value enhancement, and risk assessment—to decisions around acquisition, disposal, asset allocation, and maintenance.

3. What are the 4 types of portfolio management?

The four main types of portfolio management are active, passive, discretionary, and non-discretionary.

Active management involves frequent adjustments to outperform the market, while passive management follows a fixed strategy, often mirroring an index.

Discretionary management gives a manager full control over investment decisions, whereas non-discretionary management involves advising the investor, who retains final decision-making authority.

MyAssets: Keeping Every Property Detail at Your Fingertips

Whether owning a single property or an entire portfolio, keeping every piece of property information is crucial as it serves as the backbone for better decision-making and optimal portfolio management.

With a property organisation tool like MyAssets, users can centralise all vital documents and data, making it easy to retrieve information. From entering the property name, address, purchase date, and acquisition price to uploading records like property deeds, MyAssets keeps everything in one place.

Monitoring property value? MyAssets allows its users to manually input the current valuation, enabling them to view their portfolio’s performance over time.

It gets better. Users can add physical assets such as furniture, art, collectables, and other valuable items, then associate each one with a specific property. This feature makes it easy to know the location of items, ensuring users know which property holds what.

Every detail. Every property. All in one platform. Try MyAssets free for 14 days.